I remain bearish on USDJPY. Yen is still bid and I feel that USDJPY’s proxy for risk behaviour is outpacing actual market sentiment towards equities, which is why I feel there is downside available. In addition, Kuroda has said that it is ‘not desirable’ for the yield curve to flatten. That means potentially that the BOJ will look to satisfy their hunger for QE to prevent the deflationary hole they have spiraled into. You could start to see yield upticks on longer term Japanese Govt Bonds if this is the case. We know that negative rates are not a long term solution, so it is almost certain this is what will need to occur.

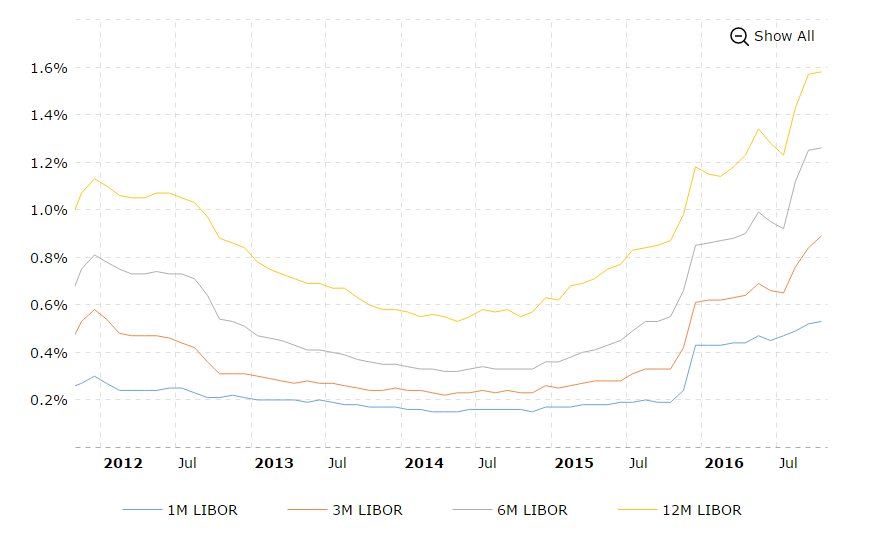

Another issue we have is that there is a decoupling between LIBOR and short term interest rates.

When USD is in low demand, the LIBOR rate rises and vice versa for high demand. If you look to pre-08, banks were very much unwilling to lend out dollars, which caused LIBOR to rise. We are seeing the same thing occurring, as well as the well discussed TED spread, a liquidity risk indicator on upticks.

In addition, Yen is being used heavily as a funding currency with the Japanese buying foreign bonds very heavily. This further leads to a USD demand tightening with foreign investors looking to borrow Yen and lend USD. This is why we are seeing the USD falling heavily vs JPY and I feel it will continue to do so.

Credit/Source: https://davidbellefx.com