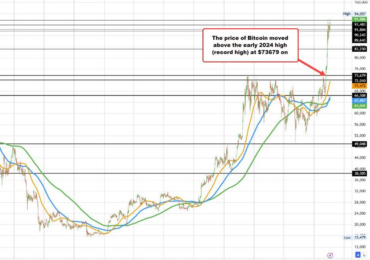

Investing.com — prices took a nosedive, dropping 30% over the past week to hit a multi-month low of $49,120 on Monday, down from a high of $70,000 on July 29. At the same time, mining stocks fell by 18%, while the only saw a 3.1% dip.

H.C. Wainwright attributes the sell-off in the crypto and equity markets to three primary factors: the fears of a hard landing for the U.S. economy after weak data, the unwinding of a popular global carry trade following the Bank of Japan’s rate hike, and escalating geopolitical tensions in the Middle East.

“We saw this price correction coming, and the pain might not yet be over,” wrote H.C. Wainwright. The firm expected back in mid-April, when Bitcoin was trading around $66,000, that the primary coin could retrace to the low-to-mid $50,000 range in the short term due to macro-related headwinds and geopolitical risks.

Despite the medium- and longer-term bullish outlook, H.C. Wainwright…

Read More