Understanding Forex Trading Psychology

The topic of Forex trading psychology is a big topic when it comes to profitable trading. This has to do with the psychology of trading rather than the technical knowledge of trading as well as the skills in the application, which are considered as the major reasons for costly trading errors.

Most traders constantly make mistakes and still continue to make those mistakes even in the event that they constantly lose money, and this is a trait common amongst many traders today, which means that it is not secluded to a particular set of traders. A common psychological trait that creates a fight or flight response amongst traders is fear. This fear is so dangerous and has caused the downfall of many traders today.

We as humans have been designed to function in a specific way, one of which is to fear, especially when we find ourselves in uncharted territories. However, we can change our approach towards the feelings of fear by learning the trading psychology of successful forex traders and then applying such discoveries into our trading tactics as well. This article is targeted at the different actions we should take with regards to different trading situations – with all information derived from the best forex trading psychology experts.

It is known that fear can have highly restrictive effects on the way we trade as well as our trading behaviours. When we look at this from a trading point of view, your mind naturally tries to look for the safest option to ensure you do not lose your money, in fact, your natural instincts would tell you to pull out of a trade the minute it looks like you are going to lose, to prevent additional loss.

This instinct is not a bad thing as this is the normal response your mind is programmed to give. However, this instinct can pull you away from a trading strategy you have carefully prepared and planned. Moreover, this fear can cause you to make impulsive decisions, and in a bid to turn the so-called losing trade around, you end up losing more than you were supposed to lose before it you were supposed to lose in the first place.

When you fear while trading, your mind always plays you into thinking about the short-term losing positions and how you can make a profit from it rather than allow you to follow your well-designed long-term trading plans.

Understanding the importance of trading psychology in Forex would allow you to forget about your fears and, instead, focus better on your decision-making process to help you make the most out of your trading adventures. Once you can spot your fears as an individual and as a trader, you would be able to tackle it and re-establish control over reasoning and logic, which is the best way to make great decisions as a trader.

Different Types of Trading Bias

One thing I understand about trading is that before the market opens, it is easy for a trader to show confidence, remaining calm, and collected. Once the market opens, this is another story entirely because, at this point, you are faced with financial decisions that have serious financial consequences, making it difficult to control emotions. So, we have come to realize that when it comes to these emotions, we cannot avoid them, but we can look for a way to work around them.

As a trader, one thing you must never do is to give in to feelings of greed, fear, and excitement when trading as these feelings can cost you dearly.

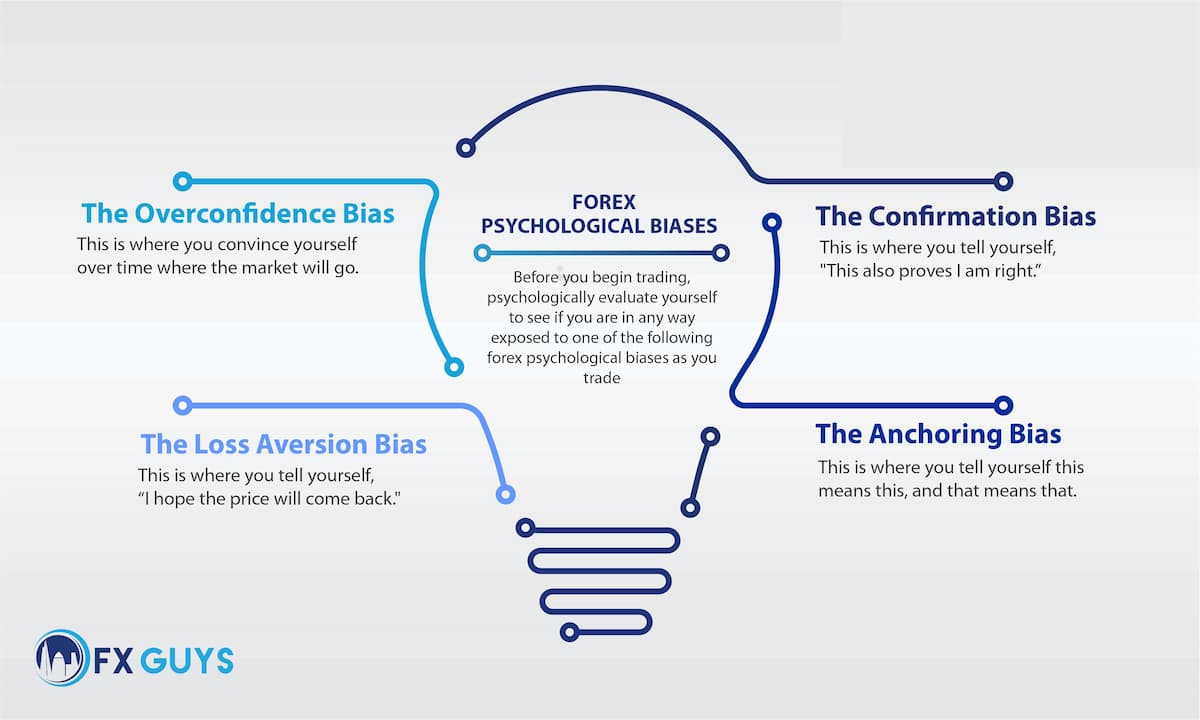

Before you begin trading, psychologically evaluate yourself to see if you are in any way exposed to one of the following forex psychological biases as you trade.

- The Confirmation Bias: this is where you tell yourself, “this also proves I am right.”

- The Anchoring Bias: this is where you tell yourself this means this, and that means that.

- The Loss Aversion Bias: this is where you tell yourself, “I hope the price will come back.”

- The Overconfidence Bias: this is where you convince yourself overtime where the market would go.

One thing you would notice here is how these biases overlap because no matter how you look at each of them, they all boil down to the fear factor. On the other hand, we would take out time to discuss all of these biases in detail because the most important step is to become conscious of our emotions.

Before we go any further, it is imperative to note that the best way to dodge pointless risks when you trade is to make use of a demo account. With the use of a demo account, you can trade without risking anything; here, you can practice the art of mastering your emotions without risking any of your capital. When you have done this, when you have mastered your emotions in a risk-free environment, then you can start trading in an environment where you can invest your capital without fear of determining how you operate.

The Confirmation Bias

The confirmation bias is a bias that affects many professional traders today. The confirmation bias keeps you in a position that would confirm or support your decision, even if it is a rash decision. This makes you look for ways to justify your strategies and actions even when you have made a wrong decision. The problem with this is that you do not try to improve your trading skills; instead, you keep on making the same trading mistakes all the time, leaving you in a position where you begin to wonder if trading is actually profitable as people claim it to be.

One of the best ways to put this is that even though the trader knows something to be true, he would keep on wasting time finding out about something he already knows to be true. At this junction, one of the most probable things that might occur as a result of following this bias is a loss of capital, a loss of valuable trading time as well as the inspiration to trade.

As a trader, one thing you have to keep in mind is you have learned how to trade, and since you already have, you have to trust yourself and be happy to use the techniques you have gathered to develop trading strategies that are profitable and follow them without doubt and fear to keep you from making the right moves.

The Anchoring Bias

According to trading psychology, this is one of the biases that deals with creating mental comfort zones when making your analysis of the market, where you think that the future would be the same as the present based on the reason that the present market analysis looks like that of the past. Just like other biases, this bias is directly borrowed from social studies.

The process of anchoring simply means an inclination to depend on what you already know as a trader for making future decisions when trading. Instead of looking at the new situations and the changes that come with them, you rely on what is already known. When you anchor, you rely on old, obsolete, and irrelevant information for new trades, which would make it hard to trade effectively.

Speaking practically as a trader, this issue manifests when traders hold losing positions for a long time, simply because they fail to look through the options outside their comfort zones. As a Forex trader, trying new things outside your comfort zone should be something you are always willing to try. You must, at some point in time, be willing to go against what you know as a Forex trader for you to continue to remain relevant because if you continuously anchor yourself to useless and outdated knowledge and strategies, you are increasing your chances of suffering greater losses.

The Loss Aversion Bias

One thing that trading psychology has taught us is the fact that the loan aversion bias derives its powers from the prospect of history. As humans, we have an amusing way of evaluating losses, gains, as well as relating their supposed meaning against each other. For example, when considering your options before choosing, you should be more willing to give preference to a lower possible loss than a possible reward. No matter how bad fear is, it is a better motivator compared to greed. Practically speaking, a trader who has a loss bias is more open to cutting profits when they are still low while consenting with more significant drawdowns.

The overconfidence Bias

This is one of the primary lessons in Forex trading psychology, where you have to watch out for trading elation. Humans are naturally inclined to focus on self because we want our egos to be validated by proving that we know what we are doing, and are better off than most traders out there today. The only information we hold dear is those which confirm our thoughts about our self-image and our knowledge of trading.

The problem with this trading psychology is that it prevents us from admitting, even if things are not right. Once we complete a series of trades and they all turn out right, we end up feeling like we are the master traders, which is really not the best way to go about things. This way of thinking is very bad and unprofitable for traders. To be a successful trader, you have to make sure that you analyse all your trading sessions, looking at your losses and wins in detail to see where you can perform better.

This is the only way you can continue making profits while you trade. You have to understand that making mistakes is a part of learning, and the only mistake you should not make is not admitting when you are wrong. Doing this, you’ll be in a better trading position, making a profit, and losing less. Mistakes are unavoidable, especially when you start trading, but it would only make you a better trader.

Trading Mistakes and Remedies

Trading psychology is only one part of profitable trading. Alongside this, one must understand some of the big mistakes traders make and try to remedy them. Some of the mistakes traders make are done repeatedly, more so because they fail to understand that they are even making any mistakes whatsoever. Here are common mistakes made by traders:

The lack of a comprehensive trading plan: the trading market is an active arena with boundless possibilities, and even with the right trading psychology, if you do not have a well-defined trading plan to be used in the market, you would only be trading for fun without results

Solution: always make sure that you set goals. These goals increase your confidence and empower your growth as a trader. Setting goals that are periodic and attainable based on performance and results is a good way to measure the success of a trading operation.

Acting on tips: making a decision while trading based on tips and inside information is often a product of trading emotionally and goes against everything that proper trading psychology stands for. The thing about most of these tips is that they spread fast and is priced into the market already.

Solution: as opposed to waiting for hot tips, try to implement trading strategies that would help you profit as you trade. Take out time to learn as you earn because it is then, and only then you can master the art of trading and make out what you want to from the adventure.

Not having a defined money management strategy: managing money is a non-negotiable factor when it comes to trading. Most of the people who I have come across have explained that this is as important as having good trading psychology. No matter how skilled you are, if the fundamental principles of managing money are not in place, you might likely often expose yourself to undue risks in the market

Solution: try implementing a money management strategy that clearly defines everything as you trade, including profit on a winning trade and cost of a losing trade. Once you can properly manage your funds, you reduce anxiety and fear, which leads to better trade outcomes.

We understand fully well the importance of a well defined and dusted psychology when trading. We also have to know that it is not the only thing to be considered. All of these factors mentioned here work together to make our trades profitable as we would like. To take one as important and leave the other would not work the way we expect. So, with the importance of good psychology also comes the need for proper planning. Nobody can hit the mark he has not planned to hit. The combination of these factors yields not only profitable trades but also an understanding of where you are going.

Nothing stings harder than a man who gets to a place he has no idea how he got to; he would eventually return to where he was coming from initially.

Bottom Line

As traders, you have to fully understand that the art of profitable trading is a psychological game where we battle with our emotions brings us to a position where we either win or lose. If you let your emotions overwhelm you, you’ll end up losing all that you have worked for. If, on the other hand, you can master your emotions on a psychological level, then the sky is your starting point.

Over time, the one thing we have come to understand is that those who have made the most of who they are as traders did not get there by chance, they understood many things an awful lot have failed to recognize, which is the fact that nobody attains the height of success by chance. They mastered the art of using their emotions to their advantage and not giving in when they were faced with new challenges.

Most traders find psychology difficult, so they develop a trading strategy and stick to it. This is not the best way to go about trading because if you can push away the fear barrier and work through it as a trader, it is then and only then that you can become truly successful as a trader. Keep on practicing, keep on drafting new trading strategies, and keep on making mistakes. Making use of the trial by error method of trading is a good part of the forex learning curve, with many traders, both old and new, proving that this is the best way to learn how to trade.

This article does contain and should not be taken as an article containing advice on investments, solicitation for any transaction in financial instruments as well as investment recommendations. Please note that such analysis is not a consistent indicator for the current or future performance as circumstances may change. You should, therefore, make it q point of reference to seek the advice from your independent financial advisor to make sure that you get advice based on your personal circumstances where you would get a chance to understand the risks involved.