INTRODUCTION TO THE NASDAQ INDEX AND WHY IT IS IMPORTANT TO TRADERS

The NASDAQ index is an index that consists of the 100 most dynamically traded and largest companies listed on the NASDAQ stock exchange. This index is a benchmark index for US technology stocks, even though it includes companies in the health, retail, biotechnology, and industrial sectors as well.

Many traders follow this index because it offers them exposure to market price actions as well as fluctuations that occur daily. This index is known for two things:

- Volume

- Volatility

One good thing about this index is that, compared to other major indices, it is protected by strict US rules and regulations guiding the federal exchange. In a bid to understand this index better, especially with regard to its importance to traders, we are going to cover some important factors below:

NASDAQ Trading Hours

The main trading hours of the NASDAQ index are as follows:

- The US stock exchange opens between the hours of 9:30am and 4:00pm local time.

- The Shanghai stock exchange opens by 9:30am and closes at 4:00pm local time.

- The London stock exchange opens at 8:00am and closes at 4:30pm local time.

How to Trade NASDAQ CFDs

The NASDAQ price usually helps traders with a high level of liquidity, tight spreads, and extended trading hours. Some of the largest technology firms in the global marketplace are NASDAQ 100 companies.

You can trade the NASDAQ 100 index live by making use of the CFDs (contracts for difference). Making use of the CFDs to trade with NASDAQ will allow you to go short or long without the problem of dealing with conventional exchanges.

How is the NASDAQ Calculated?

Like other indices in the global stock market, the NASDAQ index keeps track of many individual companies, mainly because their stock price changes would have an impact on the index for the entirety of the day.

The value of the index is equal to the cumulative value of the share weight of each security, all multiplied by the last sale price of each security, all divided by the divisor of the index. To trade on the index, the company must be listed on the NASDAQ in the Global Market tiers or the Global Select.

NASDAQ listed companies must also have the following properties:

- Be free from any form of bankruptcy

- Be publicly offered for a minimum of three months

- Submit both quarterly and annual reports

- Have a daily average volume of up to 200,000 shares

The NASDAQ is capitalisation-weighted, which means companies with larger market caps have a more significant influence on the NASDAQ index price. Many of the companies trading with NASDAQ are put through a quarterly review, and they are added and removed from the list based on their market cap size, with no company having more than 24% weighting.

Either way, the NASDAQ should never be confused with the NASDAQ composite, as the composite includes up to 3,000 stocks traded in the exchange. The NASDAQ 100 holds the account of about 67% of the total market cap of the general NASDAQ composite.

History of the NASDAQ

In 1985, the NASDAQ was launched with an initial base price of 250. Then, after the price spiked to 800 in December 1993, the price was reset to 125 the following day. Once the NASDAQ was launched, it opted to promote itself alongside the New York Stock Exchange with the formation of two indices which we know today as:

- The NASDAQ 100 – which comprises companies in the retail, health, media, transport, science, and biotechnology sector.

- The NASDAQ FINANCIAL 100 – which also comprises brokerage companies, banks, and insurance firms.

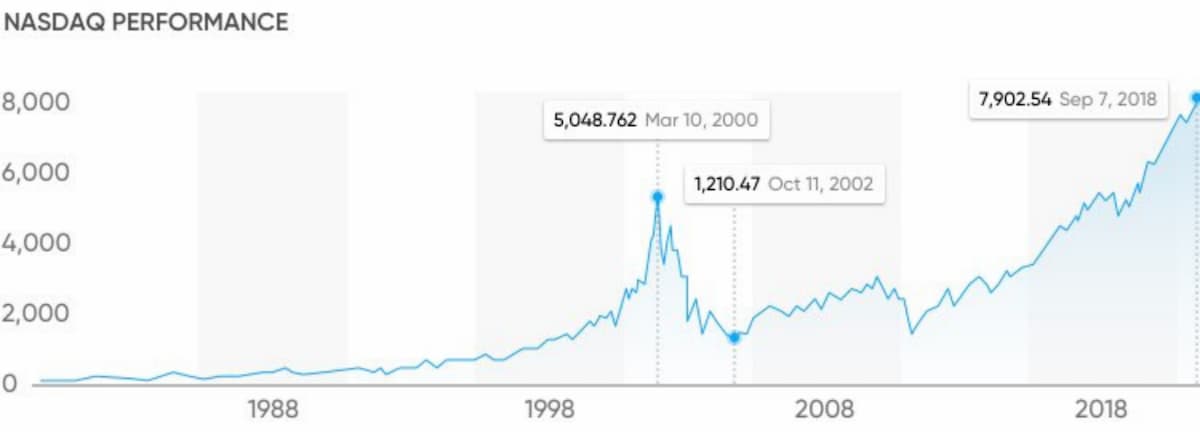

With the formation of both indices, NASDAQ predicted they would have a better chance of getting options and futures traded on them, with mutual funds adopting them as a benchmark measure. The NASDAQ 100 has a closing high of 7,660.18, which was set on August 29th 2018, with an intraday high of about 7,700.56, which was reached on October 1st 2018. When there was a financial crisis in 2008, the NASDAQ entered a record low of 1,018 on November 20th 2008.

NASDAQ Listing Requirements

For security or stock to be listed on the NASDAQ exchange, there are certain requirements a company must meet based on corporate governance, finances and liquidity. The security and stock must have at least three market markers, and they must be registered with the Security Exchange Commission (SEC). When the application is submitted with everything completed, it will take at least five weeks for the listing to be accepted.

NASDAQ Market Tiers

We have highlighted the NASDAQ listing requirements, and based on these requirements, the stocks of a company would be listed on one of three market tiers. Companies that are listed on the Global Select Market must pass the most rigorous requirements, while those listed in the Capital Market will go through the least rigorous requirements.

- Global Select Market

In this group, we have stocks of up to US$1,220, as well as international companies weighted based on the capitalisation in the market. These companies are appropriately scrutinised and must pass some of the highest standards set by NASDAQ. The listings for the global market are surveyed annually by the NASDAQ Listing Qualification Department, which will give them access to the Global Select Market if they are deemed eligible.

- Global Market

The NASDAQ global market consists of 1,450 stocks of major companies listed in the United States as well as globally. As far as statistics are concerned, this is considered to be the mid-cap of the market.

- Capital Market

This is the section of the NASDAQ market that consists of companies with lower capitalisation in the market. This was formerly known as the small-cap market.

Performance of NASDAQ

We know that the majority of stocks that make up NASDAQ are mostly tech stocks, and with the growth of the tech sector, we can say that the performance has been strong, particularly in the past 25 years. When taking a look at stock records, as of June 2018, the NASDAQ index reported a massive five-year return of up to 155%, and 240% in the last ten years. Also, the NASDAQ biotechnology index reported about 138% returns after five years and 312% after ten years, which was a massive high for the companies in the index.

Graph showing the performance of the NASDAQ index

Other Facts on the NASDAQ 100 Index

Here are some additional facts you might not know about the world’s most popular indices:

- The NASDAQ index is the home to many companies at the top of the innovations in their respective industries: The growth in sales of these index companies is among the highest in the industry overall.

- This index contains over 100 stocks. Usually, the index had been constrained to 100 common stock issues, with every user having access to just one stock. Now the index has been redesigned and limited to only 100 users who have access to multiple issues as index components. Today, the index has 103 components that represent 100 issuers, and four of the major ones are from china: NetEase, Ctrip, Baidu, and JD.com.

- The large-cap index. One other interesting fact about this index is that the smallest companies here have proven to be larger than the smallest of standards for other large-cap companies. This goes to show that members of this group have a common goal, which is to disrupt their respective industries and take constant growth as a priority. For this index, there is no committee making prerequisites for memberships. Investors determine membership because inclusion is based on market cap rankings.

- Only non-financial companies allowed. The NASDAQ 100 index is well known as the base for the most popular companies in the technology sector. It also has its roots in other sectors, such as the health care and customer service sector. The index has made it a point of reference to omit the financial industry as well as the oil and gas, utility, and basic material stock, even though at some point, they had been present in the index.

- Getting into the index. As we should expect, being one of the biggest non-financial companies listed on the NASDAQ Stock Market, some regulations must be met. i.e., to be eligible for entry, you must have a minimum of 200,000 shares per day as your average daily volume. Another important requirement is that the security must have been listed on the market for more than three full months.

This index is one of the most successful and relevant large-cap growth indices. Apart from serving as an indicator for the value of its components, the index has been highly successful as the foundation for tradable products. There is a wide range of financial products that track the NASDAQ-10, which include mutual funds, structured products, UITs, futures, and options.