Natural gas is one of the most frequently traded commodities out there. Being a very volatile product, it presents many opportunities for traders. In this article, you will learn about natural gas trading, identify the factors that affect its price, and find out about useful strategies.

Natural Gas Trading

Natural gas is presently the second most used form of energy for the generation of power, representing 22% of the globally generated power as of 2017. The popularity of natural gas trading has been on the increase with developing countries, such as Indonesia and China, continually making use of this product during the last decade.

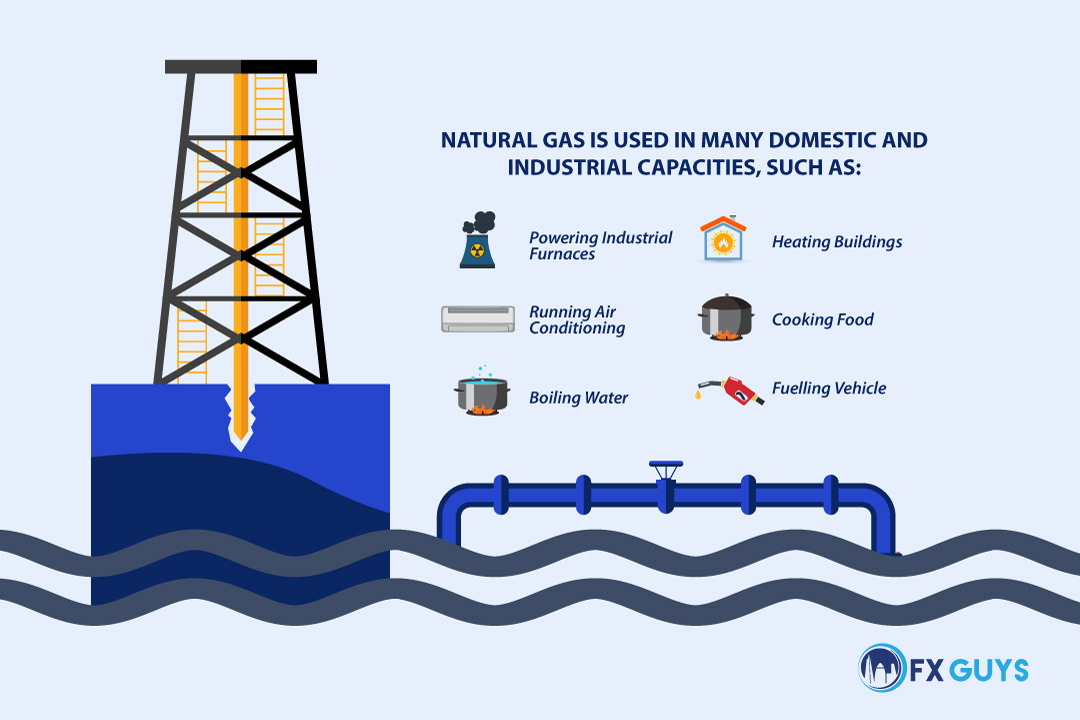

Natural gas is used in many domestic and industrial capacities, such as:

- Powering industrial furnaces

- Running air conditioning

- Heating buildings

- Boiling water

- Cooking food

- Fuelling vehicles

Many of our household appliances, such as radiators and gas hobs, function by turning the energy supplied from the gas into heat. Now that we have covered the basics of natural gas and how it is used, let us now turn to natural gas trading and discuss some of the factors we need to understand before we proceed:

- Trading natural gas is popular among traders because of its volatility; this is due to a number of causative factors that can be exploited through research and proper market timing.

- It is imperative that traders understand what affects the prices of natural gas, such as demand, weather, and supply, and take advantage of them.

- Traders can make informed decisions on their trading activities using technical analysis and fundamentals.

- Becoming familiar with natural gas trading hours can improve your trading strategy.

Why Trade Natural Gas?

As we highlighted earlier, natural gas is a popular commodity used by many individuals today, which also makes it popular for many traders. But why is there more emphasis on trading natural gas compared to other commodities?

The first reason is that it has a reasonable spread, which is highly liquid, making it easy for traders to get in and out of trades with little or no difficulty. Natural gas trading makes use of the same strategies that are used for other popular and simple commodities such as crude oil and gold. This commodity makes use of fundamental and technical analysis as well as providing a good understanding of factors that affect natural gas such as storage, supply and demand, and weather. Many traders pay attention to major natural gas producers such as Gazprom, the largest natural gas producer in the world, Royal Dutch Shell, and BP because trading in these companies allow traders to track the underlying price of natural gas. As we move on, we will cover the basics of trading natural gas as well as tips that could help traders improve their strategy.

The Basics of Natural Gas Trading

When trading natural gas, there are some fundamental things you need to understand:

- Make sure you understand what affects the prices of natural gas.

Most commodities are traded in the same way as natural gas. However, the price of natural gas tends to be connected with the supply and demand inventory of the commodity. The price of natural gas is aligned with the basic economics of supply and demand. This means that the price would rise when production levels fall and decline when production increases. Here are four factors that affect the supply and demand of natural gas:

- Economic growth: increased economic growth, particularly in the industrial sector, can push the price of natural gas up as demand will rise for consumables and services rendered.

- Weather: abnormal or extreme weather conditions can push or pull on the forces of supply and demand.

- Alternatives: substitute products, especially ones that are eco-friendly, such as wind and solar power, affect the price of natural gas; with many countries’ increasing efforts to go green, these alternative energy sources will become more pertinent in the future.

- Storage: the supply of natural gas in storage would affect the price of natural gas, and this is based on whether there is a deficit or surplus after delivery. If there is a deficit in storage, then prices are likely to be suppressed due to low supply, and vice versa.

2. Make sure you monitor the major producers of natural gas.

A well-planned natural gas trading strategy involves keeping an eye on the major producers of natural gas. When an economy is strong; there is a high demand for fertilisers, power, and industrial goods and services. Therefore, whenever there is an improvement in the economy, there would also be higher prices and an increase in demand.

Taking time to monitor these major producers would give you a better understanding of the situation and effectively help you strategise.

How to Trade Natural Gas Using Technical Analysis

Making use of technical analysis allows traders to evaluate past trends using different oscillators, price movements, and indicators. Trading natural gas can often be a repetitive process; it could make use of technical analysis in the most effective way to capitalise on price movements.

The price of natural gas moves in a repeated pattern, which can be seen as cyclical in its disposition – a factor caused by weather. Prices tend to be higher in winter and summer and decrease during the remaining months due to lighter weather conditions. The cyclical movements in the pricing of natural gas make it something that is anticipated by traders, which allows for speculative trading.

One of the popular speculative natural gas trading methods is swing trading. With swing trading, traders have the ability to trade based on trends that allow for setting up of positive risk-reward ratios, limits, and stop losses. Indicators are used to confirm trends and, thus, reinforce a trader’s confidence in the trade’s direction.

Natural Gas Trading Hours

Becoming more familiar with natural gas trading hours is important when securing a solid foundation in trading natural gas. Based on the global standard price reference for natural gas NYMEX Henry Hub Natural Gas Futures (NG), it is important to note the market times below:

5:00 pm – 4:00 pm (Sun – Fri) CT with a 1 hour break each day beginning at 4:00 pm CT.

Basic Technical Analysis for Trading Natural Gas

Most traders who are still new to trading natural gas prefer to make use of chart patterns, support and resistance levels, and trend lines. For example, when the current price of natural gas is approaching the previous high, it can be used as an apparent target, and the same can be said when a price is approaching previous lows.

Trend lines are used to identify and confirm a direction that can be achieved by joining uptrends or downtrends. These trend lines can also be used as support and resistance levels.

RSI indicators are used not only to discover oversold and overbought levels, but also divergence levels. Divergence can be used to highlight possible trend reversals meaning that if the market is in a bearish state, the RSI could show higher lows, while the instrument shows lower lows. The separation between the indicator and the price could potentially forecast a reversal of the underlying instrument.

Advanced Technical Analysis

Moving from the basics to sophisticated trading, techniques such as Fibonacci retracement, the Elliot Wave Theory, and Ichimoku are used. Once a trader understands the fundamental factors that affect the price of natural gas, technical analysis can be utilised to target market entry. Timing your market entry is important if you want to trade successfully; thus, it is important to explore some of these advanced techniques. We can, therefore, say that thorough research regarding fundamental and technical analysis is essential for both new and advanced natural gas traders. Incorporating these dynamic techniques will prove to be valuable as an overall assessment of the natural gas market.

Conclusion

Natural gas is something that we can say is important to many aspects of civilization. Even though the initiative for other forms of energy is on the rise, we can say that natural gas still has a lot to play in the affairs of many economies today. With that said, we can all agree that trading natural gas is a profitable venture, one which is profitable for many traders. Traders will benefit from taking time to digest the information provided here alongside other important and relevant information.

This article is intended to be used and must be used for educational purposes only. It is very important that you conduct personal analysis and make your investments based on the situation you find yourself in at the moment. For more information, you should seek advice from an Independent Financial Adviser in connection with this information and verify any information you wish to make use of from this article, whether for the purpose of making an investment decision or otherwise.

We like to keep our pages fresh and update them periodically. Sign up to stay in the loop with the latest FX Guys News!