Planning to invest in gold? Here are the gold trading options that you have

Individuals have looked at gold as an asset and as an investment for thousands of years. Whenever the stock market turns volatile and the economy stands on shaky ground, investors rely on gold trading. Thus, it is understandable if gold is on your mind. All you need to do is double-check the goals and consider a long-term investment strategy, and chances are that gold will fit perfectly in your portfolio.

But, before you go ahead and invest, it is crucial that you understand all the different types of options that you have and how the trading system works for gold. As the popular saying goes, ‘all that glitters is not gold’, and you certainly would not want to learn this the hard way. The risk of loss is as high with gold as it is with any other kind of investment, and that risk increases ten times if you do not have all the facts.

So, since you have made up your mind about getting into gold trading, here are all the options that you have, along with a brief overview of the pros and cons of each of the options. Read on and decide your future course of action for yourself!

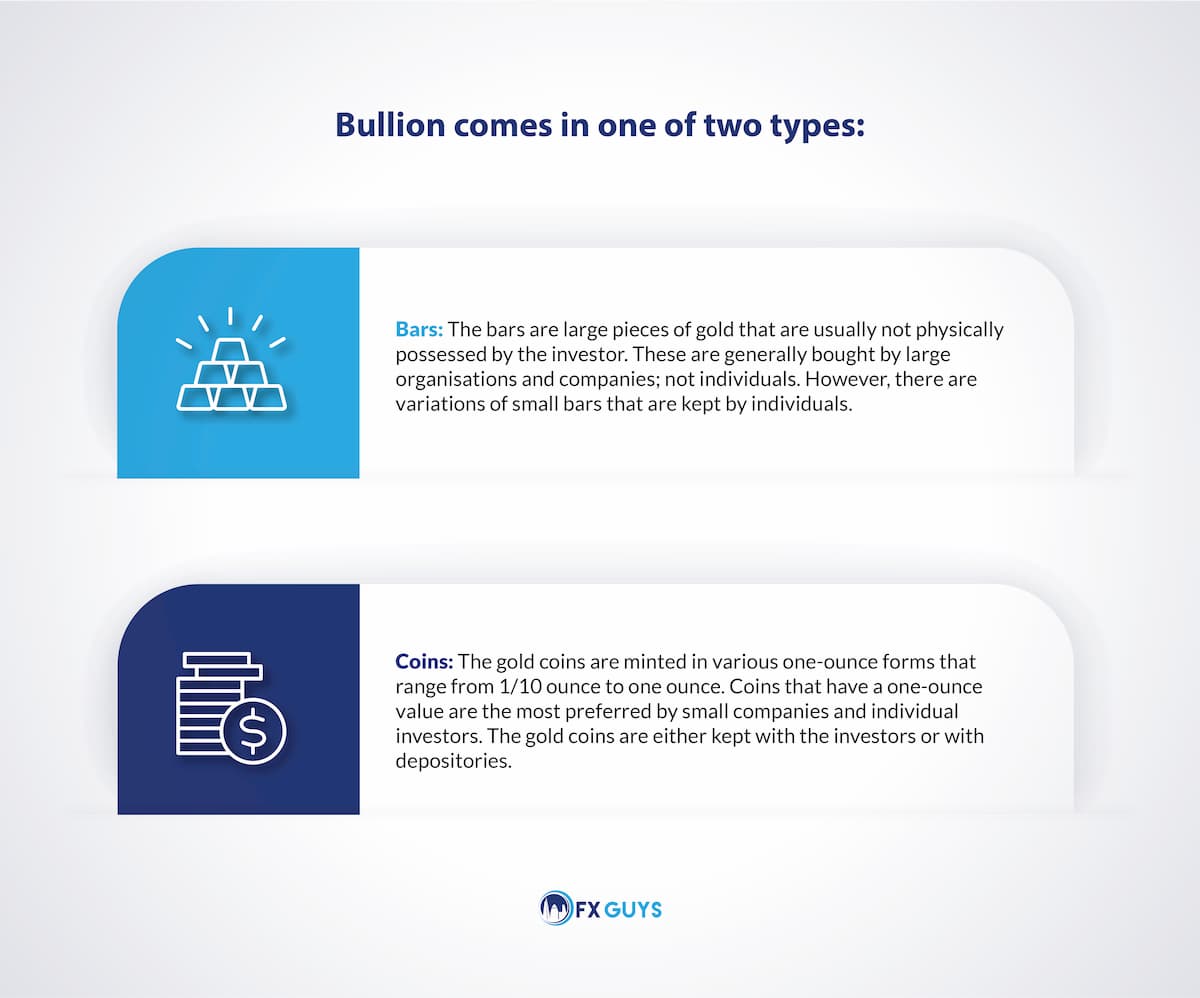

Bullion

Physical gold is usually a part of the investment portfolio for most individuals dealing with gold trading. It can be invested in the form of gold bullion, gold coins, or gold jewellery. The worth of gold bullion is determined by the market prices of the gold almost completely during the time of its purchase.

Advantages and disadvantages

The biggest advantage of physical gold is that the investor can have direct ownership and keep the value. While the current state of the economy has certain impact on gold prices, a poor economy doesn’t essentially make the gold price go down.

One of the biggest disadvantages of gold is that it lacks liquidity, making it an efficient short-term investment. Often you tend to buy gold from a dealer, meaning you have to pay slightly over the market price at that particular time. The process is the same when you sell the gold and dealers generally pay less than the market price. So if you want to quickly sell the gold in hand, you are likely to receive less money than you invested initially.

A detailed insight into the bullion market

The bullion market is the one through which sellers and buyers trade silver and gold along with the associated derivatives. The London Bullion Market is the primary bullion market globally as far as being a trading platform for silver and gold is concerned.

The bullion market, as mentioned before, is the market for silver and gold trading. This market is the main source for the daily trading quotes of silver and gold. There are countless bullion markets all over the globe. These are generally categorised as over the counter markets. The largest markets for gold bullions are in London, Tokyo, Zurich, and New York. Trading in this market is known to bring a high turnover rate, and the transactions are all done either over the phone or electronically.

The industrial usage of silver and gold is the main market driver for the price of precious metals. Silver and gold traded in the bullion market can, at times, be utilised as a hedge against inflation or safe-haven trading, which might also affect the investment value.

Apart from the bullion market, there are other ways of investing in silver and gold. You can look into mutual funds and exchange-traded funds for that purpose. These options provide more flexibility and they seem more feasible to many investors. As of August 2019, the largest gold exchange-traded fund by assets is SPDR Gold Trust. It had an asset value of over $41 billion with a trading price of $144.19.

Physical bullion comes with less flexibility in trading as compared to silver and gold investments, as, after all, it is something tangible in the form of coins and bars of different sizes. This makes it difficult to sell or buy in particular amounts. Besides, bullion can also be expensive to insure and store.

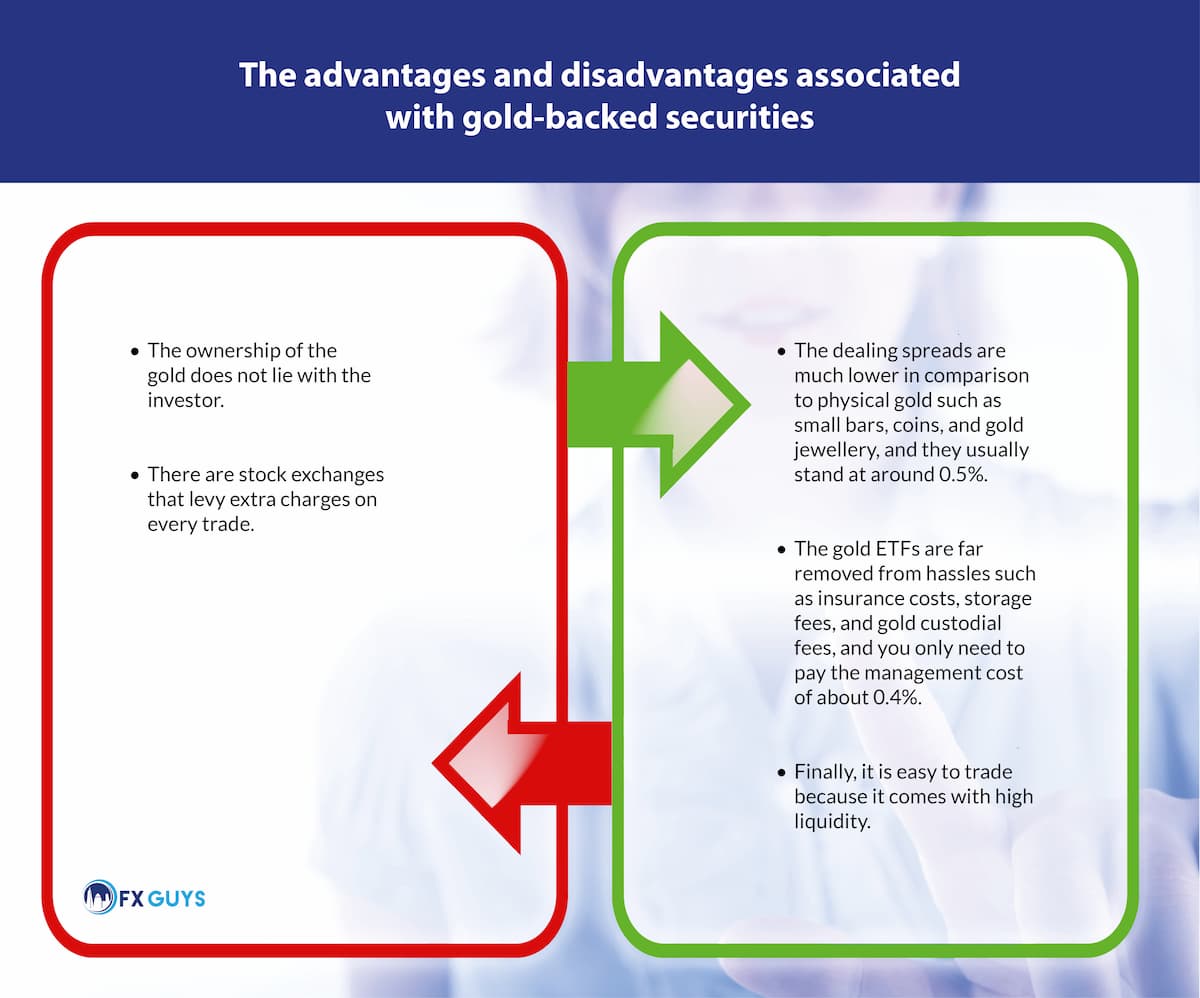

Gold ETFs

Gold ETFs (exchange-traded funds) are one of the ways of investment through which you can indirectly invest in gold. They bring together the liquidity factor of the traditional security market along with all the advantages of physical gold bullions. Generally, the gold securities are redeemable, but the fee associated with that redemption is quite high, to stop trading gold from becoming too frequent.

Gold ETF is a lot like stocks due to the fact that it is one of the investment funds that is traded on the stock exchange. Gold ETFs are different from stock ETFs because the former is like a financial derivative that tracks the spot gold value.

The uses and the market condition of gold ETFs

Gold ETFs provide some of the similar defensive asset traits as the bonds, and many investors utilise these as hedges against political and economic disruptions and currency debasement. Gold prices generally rise when the dollar remains weak. Thus, if the investment portfolio has assets that come with risk exposure to the downside of the dollar, buying a gold ETF might help you to hedge the exposure. Similarly, selling the gold ETF can serve as the hedge if the portfolio has enough exposure to the upside.

The gold ETF is like a commodity exchange fund that can be utilised for hedging gold commodities or gaining exposure to the oscillations noted in gold itself. If the investor comes with a high-risk factor on the portfolio assets when the gold prices increase, having the gold ETF can really help in the reduction of risk in that situation. Also, when, after enough research, the seasoned investor decides to rely on gold, then trading the inverse ETF might be a good way of strengthening the portfolio for that situation.

There are many kinds of gold ETFs that you can explore. However, before including these in an investment strategy, make sure you take into account the performance of a couple of other popular funds. Check their movements and consider if that is what your portfolio needs. Having a better understanding of the ETFs will make it easier for you to invest in them. Three of the most well-known ETFs in gold are:

- SPDR Gold Trust (GLD)

- iShares COMEX Gold Trust (IAU)

- Invesco DB Gold (DGL)

Don’t think these are the only options that you have because there are varieties of gold and silver ETFs out there, if you want to know more about other such gold ETF options.

- Gold mining stocks

Gold stocks are basically the stocks of the companies that are concerned with gold. The industry has gold mining companies that deal in mining and selling gold. Thus, on purchasing the stocks of a gold company, you basically buy a stake in its ownership, and your returns are determined by the performance of the company.

The gold mining sector is pretty extensive and there are more than 300 gold mining companies that are publicly traded and listed. The market values of these companies range from micro-cap companies to those that have a market capitalisation of over $10 billion USD. The universally recognised indices that offer benchmarks of global gold mining performances include S&P/TSX Capped Gold Index, Philadelphia Gold and Silver Index, FTSE Gold Mines Index, and NYSE Arca Gold BUGS Index.

The advantages and disadvantages

When you buy gold mining stocks, it is basically having a share in a gold mining company and not actually buying gold. This also means that the share prices will not rise in keeping with the gold prices and several other factors are also at play here. So, for instance, the performance of the geological, management, auditor team of the company, cost base, and economic and environmental risk taken by the company, are also facts that you need to consider.

Thus, you can well understand that when you compare it with other forms of gold investment, it is highly risky and speculative. This high-risk factor of gold trading is one of the reasons why investors interested in gold mining stocks should really consider their decisions carefully. This is the kind of investment for which the investors need to have a high-risk tolerance and the ability to consider the chances of gold-related losses for gains in triple digits.

The present market conditions of gold mining stocks

The present situation of increasing gold prices is great news for the gold mining companies because the higher prices will positively impact their revenue. Until now, 2019 has been a great year for gold prices, and so, this is also the time for you to consider buying gold stock and adding it to your existing portfolios.

In fact, there has never been a better time for getting into gold mining stocks. The industry consolidations have made every investor hopeful. There have been two recent deals: Randgold Resources merging with Barrick Gold, and Newmont Mining acquiring Goldcorp. What makes these deals huge is that the two biggest publicly traded gold companies have been created. It is also important to mention that this joint venture has started operating in Nevada as of now, but soon they can spread to other parts, thereby making gold investments more lucrative.

The industry is not all about mining companies because you also have royalty and gold streaming companies that act like the middlemen here. The two gold streamers of Royal Gold and Franco-Nevada are the names to reckon with as far as gold trading is considered.

As far as gold stocks are concerned, the names Barrick Gold and Newmont Mining come out on top, with the market capitalisations of $23.29 billion and $18.33 billion. Other important gold stocks also come from Yamana Gold and Wheaton Precious Metals. The latter has earned the tag of silver stock because most of its revenue comes from silver.

- Gold mutual funds

Gold mutual funds are another way of gold trading and are suited for the kind of investors who like their investments in physical gold and still want some exposure to the metal. However, there might be hidden charges and high annual charges involved, which is why you need to thoroughly analyse the prospectus provided.

The advantages and disadvantages

There are many advantages associated with gold mutual funds. If you compare the investment with physical gold, for instance, you will not have to think about the purity of gold because the fund house has the responsibility of taking care of that. Also, there is no need for you to buy in massive quantities because a unit is equal to a gram of gold. You can easily buy in small quantities. Finally, there is the ease of buying because you do not have to buy a huge amount and you can accumulate gold over a period of time and use it for a later event.

However, it is not free from any disadvantages. If you compare gold trading funds with ETFs, the cost goes up a little higher. You will end up having a Demat account, which comes with transactional charges and maintenance charges. With that being said, the cost is hardly a factor if you see the profits incurred by gold saving funds.

The market conditions related to gold mutual funds

A gold mutual fund is basically an investment in refining and mining companies. The prices are based on the value of the portfolio of investments in the gold exploration companies. Though this is related to gold prices, the values of the portfolio depend on the companies’ performance and business value. Thus, the prices of the unit are connected to the portfolio value. Therefore, gold trading in mutual funds is beneficial when the investments are centred on gold exploration, mining, and so on. A gold mutual fund is the equity fund you need for diversifying your investments, given the current market conditions.

You can invest in gold mutual funds for gold trading without a Demat account, which makes it easy for people who do not have a trading account. Systematic Investment Plans help investors put in their money systematically, but you are investing in the gold companies, and not in gold metal. The good thing is that, in the case of gold mutual funds, you will still get the benefits of the cost averaging.

In terms of liquidity, you get to redeem the money from the fund and have access to it in a few days. However, NAV (Net Assets Value) decides the price upon closing. It can be said that, in this case, the benefits of volatility in gold prices cannot be considered because the gold prices might move completely differently.

- Gold investment derivatives

The gold investment derivatives, such as gold options and futures, are like short-term speculation about the future prices of gold. The market for gold trading is much more complicated and dependent on speculation, rather than in physical gold, so this type of investment is best left with seasoned and skilled investors. Most of the investors end up losing rather than winning because, in this case, the buying option is risky.

One of the main advantages of this is that the investor is able to handle a huge investment with a limited and small amount of money. However, there is also the disadvantage that these options end up expiring within a particular time period. Gold futures and options might bring forth good fortune to many investors, and it can also take it all down with itself in a matter of minutes.

- Numismatic coins and jewellery

Besides being made of gold, numismatic coins and jewellery are bought both for their value as gold and for their aesthetic, historical, or cultural appeal. In the case of a bull market, this naturally means that the value of the items will usually increase and the market prices of gold will be surpassed in gold trading. The opposite becomes true in the case of bear markets and this same item goes ahead and decreases at a higher rate compared to the bullion gold and other such options.

The factors that have a major influence on the gold prices:

There are several psychological and fundamental factors that affect gold prices, and thus, gold trading. The most common factors that have an influence on gold prices all over the world include:

- The monetary policy

The monetary policy applied by the Federal Reserve is one of the biggest influences on the gold prices. There is something called opportunity cost that impacts gold prices. It is basically the idea of letting go of a guaranteed profit in an investment for getting higher profits in another.

- The economic data

The economic data relates to manufacturing data, wage data, job reports, GDP growth, and the like, which all come together to influence gold prices and gold trading. Though it is not a hard and fast rule, it is generally seen that a stronger economy leads to lower gold prices, and vice versa.

- Demand and supply

Even the simple economics of demand and supply can influence physical gold prices. When there is an increase in demand and a dearth of supply, the prices of services or goods are pulled higher. Similarly, the oversupply of services or goods with a weak or stagnant demand tends to push prices lower.

- Inflation

This cannot be a term that is new to you. Inflation leads to a rise in the price of goods and services. Though it is not set in stone, high levels of inflation end up pushing gold prices higher, and low levels of inflation (also known as deflation) end up lowering the gold prices.

- The currency movements

The upward or downward movement of currencies, more specifically of the US dollar because the gold prices are dollar-denominated, strongly influences gold prices. Downward movement of the US dollar ends up pushing the gold prices higher, as the other currencies around the world rise in value compared to the dollar.

The Bottom Line

So, that is it for all the gold trading options that you have. Which of these have you considered lately? Which of these are you considering now that you know more about them? Regardless of what you choose, make sure you are well-informed and it is a calculated risk that you take. If you manage to do that effectively, you will definitely see that you have what it takes to be an expert gold trader!