Investing.com — BlackRock’s iShares Trust (NASDAQ

On January 2, BlackRock’s spot Bitcoin ETF recorded an outflow of $332.6 million, according to data from Farside Investors. This surpassed the previous high of $188.7 million set on December 24.

The fund has now seen outflows for three consecutive trading days, marking another record. Over the past week, IBIT’s total outflows have reached $392.6 million.

Despite the recent withdrawals, BlackRock’s Bitcoin ETF remains one of the top-performing funds in the U.S. in terms of inflows for 2024.

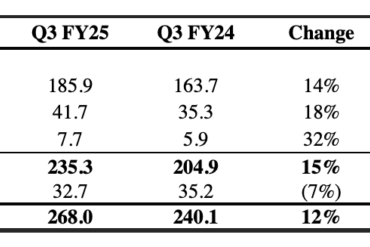

Data from Bloomberg, shared by senior ETF analyst Eric Balchunas, shows that IBIT ranked third with $37.2 billion in inflows. The Vanguard ETF (NYSE:) led the list with $116 billion, followed by the iShares Core S&P 500 ETF (NYSE:) at $89 billion.

While…

Read More