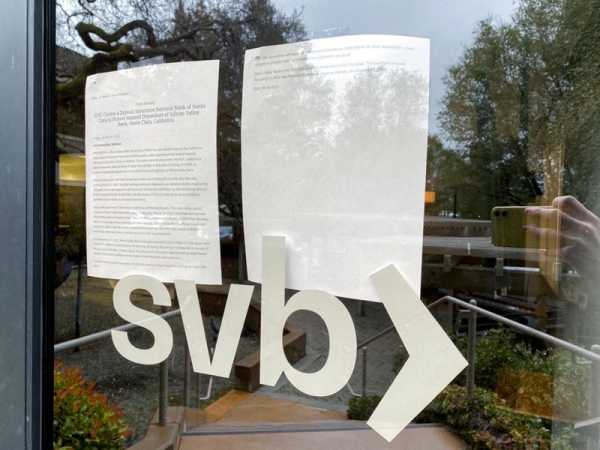

Following a weekend of discussions over the future of SVB owner SVB Financial Group, banking regulators unveiled emergency funding plans for the bank.

Billionaire hedge fund manager Bill Ackman wrote on Twitter that if authorities had not intervened, “we would have had a 1930s bank run continuing first thing Monday causing enormous economic damage and hardship to millions.”

“More banks will likely fail despite the intervention, but we now have a clear roadmap for how the gov’t will manage them.”

Yet by guaranteeing that depositors would lose no money, authorities have again raised the question of moral hazard – removal of people’s incentive to guard against financial risk.

“This is a bailout and a major change of the way in which the U.S. system was built and its incentives,” said Nicolas Veron, senior fellow at the Peterson Institute for International Economics in Washington. “The cost will be passed on to everyone who uses banking…

Read More