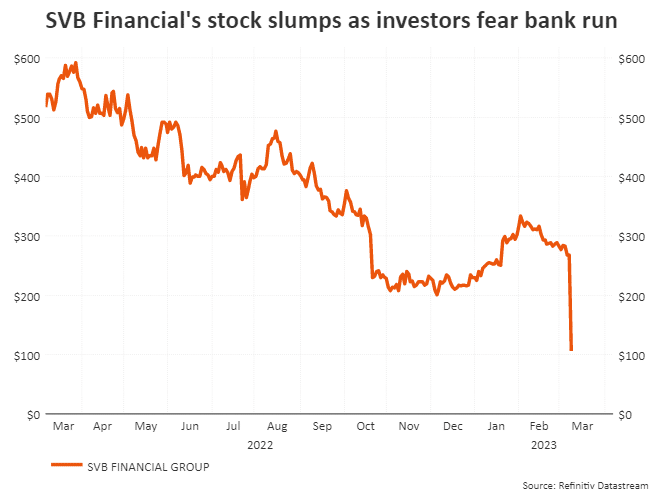

U.S. and global bank shares dived over the past 24 hours – wiping out about $100 billion in value – after west coast lender Silicon Valley Bank scrambled to reassure venture capital clients that their money was safe after a capital raise led to its stock collapsing 60%.

SVB Financial launched a $1.75 billion share sale on Wednesday to shore up its balance sheet, claiming it needed the proceeds to plug a $1.8 billion hole caused by the sale of a $21 billion loss-making bond portfolio consisting mostly of U.S. Treasuries.

The shock threw a spotlight on possible hits other banks may suffer from the renewed rout in bond prices as the U.S. Federal Reserve signals another severe tightening of credit – and the possible contagion within the banking system from balance sheet uncertainty.

While investors holding bonds to maturity can absorb bond price hits, as ‘safe’ bonds like Treasuries will pay back at par eventually, banks and leveraged investors required…

Read More