What if, they asked, they just told everyone the rate should be much lower – say roughly 2% – and then aim for that?

“It was a bit of a shock to everyone, I think,” said Roger Douglas, the Labour Party finance minister at the time who worked with the Treasury and Reserve Bank of New Zealand (RBNZ) to pioneer the policy. “I just announced it was gonna be 2%, and it sort of stuck.”

Like that, inflation targeting was born.

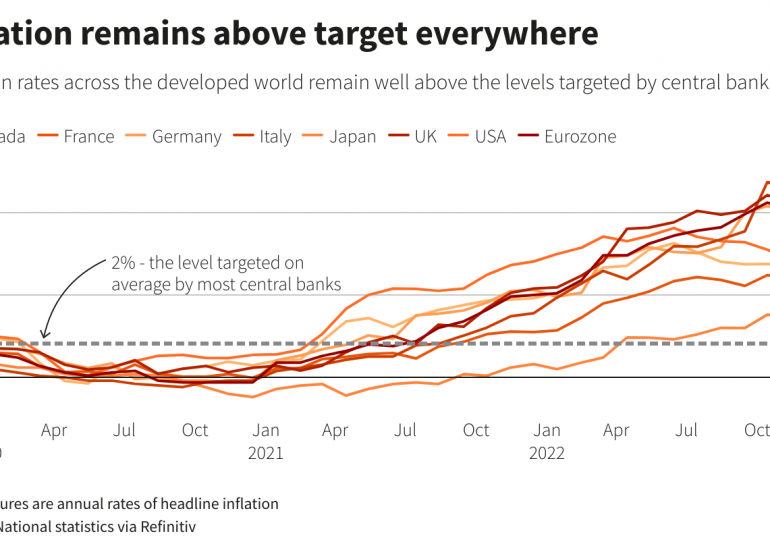

Since it’s arrival in 1990, the 2% inflation target phenomenon has sailed from Wellington around the globe to become the accepted norm among central banks, large and small, for grounding public expectations for what inflation ought to be. But the price spikes spawned by the COVID-19 pandemic are set to test their devotion to it in the months ahead as inflation looks set to remain stubbornly above 2% for some time.

As some observers question whether that level remains valid today – in most cases debating if it should be…

Read More