Forex Broker ADSS Review

CFD and Forex traders choose ADSS for outstanding customer service experience, as well as its exceptional VIP client experience. What we found in our ADSS review was that even though ADSS does offer its exclusive OREX trading platform, alongside MetaTrader, this broker still has some work to do as it trails many of the industry leaders in areas such as research and trading tools.

Founded in 2011, ADSS is regulated by two tier-1 authorities, making it one of the safest brokers to trade CFDs and Forex with. Another good thing about ADSS is that it offers excellent phone services, making it a highly ranked broker in the UK. Together with the MetaTrader platform, ADSS offers its exclusive platform suite, OREX, which was classified as a great platform when compared with platform powerhouses like Saxo Bank, IG, and Dukascopy. For traders with $200,000 or a trading volume of more than $500 million per month, ADSS’s VIP account experience is one of the best at the moment.

While the option of ADSS social trading is available for this broker, there is still room for improvement when compared to category leaders. The education and research aspect of the broker is also a let-down, which makes this broker a bad option for beginners. We are going to be taking a good look at all the major aspects of the ADSS broker.

Safety

ADSS is considered as low risk, with an overall trust score of 89 of a possible 99. ADSS is not publicly traded and does not operate any banks. It is authorised by two tier-1 regulators, one tier-2 regulator, and no tier-3 regulators. The tier-1 regulators that authorise ADSS are:

- Financial Conduct Authority (FCA)

- Securities and Futures Commission (SFC)

Offering of Investment

The table below highlights the different investment products available to clients using ADSS:

Features | ADSS |

Cryptocurrency traded as CFD | Yes |

Cryptocurrency traded as actual | No |

Forex: Spot Trading | Yes |

Currency Pairs (Total Forex Pairs) | 56 |

Social Trading/Copy Trading | Yes |

CFDs – total offered | 2200 |

Investment products on ADSS

Fees & Commission

The ADSS fees and commissions differ depending on the account type opened as well as the array of account types available on the ADSS brand that you choose, which is linked to the applicable regulatory jurisdiction as well as your location.

Hong Kong-based Account: The Hong Kong-based ADSS account lists an average spread of 1 pip for the EUR/USD Pair from its OREX platform. This base also offers the bullion account in addition to futures trading and the TREX platform, which necessitates a deposit of at least $3,000.

UAE-Based Accounts: From the UAE base, ADSS offers two accounts:

- Elite

- Classic

The Elite account is ADSS’s best offering, similar to a VIP style account, which requires a $200,000 deposit or a total trading volume of more than $500 million per month, and also comes with incentives beyond the typical discounted spread. On the other hand, the classic account has a minimum deposit of $100, making it more affordable for conventional traders yet carries a higher spread than the Elite account type.

Below is a summary of ADSS fees:

Features | ADSS |

Active trader or VIP Discounts | Yes |

Minimum Initial Deposit | £100 |

All-in Cost EUR/USD – Active | N/A |

Average Spread EUR/USD – Standard | 1.oo |

ADSS fees summary

ADSS Review for Cryptocurrency

ADSS provides its clients with access to top cryptocurrency markets by trading a cryptocurrency CFD on Ripple, Litecoin, Bitcoin cash, Ethereum, and Bitcoin. Usually, cryptocurrency investment meant buying coins through an exchange that needs a virtual wallet in which to keep them. However, ADSS allows clients to begin with cryptocurrency trading via a CFD without taking ownership of the primary cryptocurrency. All you have to do to access ADSS cryptocurrencies is to log in to your account. The listed cryptocurrencies will be quoted against the USD.

When you have to open a CFD position, instead of taking ownership of the cryptocurrency, trading will be available on whether the price of the cryptocurrency will fall or rise in value in relation to the US dollar. As it is with any CFD, if the trader predicts correctly, they will have an instant profit, but if things go the other way, there will be instant loss.

Tools & Platforms

As we highlighted in our introduction, ADSS goes far beyond the normal MetaTrader-only broker, providing customised offerings using add-ons as well as VPS hosting and Autochartist.

OREX Desktop: While the broker offers the OREX optim, we do not recommend a desktop version of the platform, which relies on Silverlight – an outdated plugin which makes it inaccessible to download using mainstream browsers – because of the difficulty experienced when trying to install from certain browsers.

OREX Web: ADSS’s flagship, OREX web platform has a better product range compared to the MT4 platform offering and is generally easy to use, minimalistic, and straightforward. Even with the simplicity of the web version of the platform, it still has unfinished modules such as the economic calendar selection labelled “coming soon” and the alerts.

Research

ADSS has an average collection of research content across the website and trading platform, ranging from the earnings calendar to the sentiment widgets, in addition to industry-standard news from top-tier providers.

Social Copy Trading: The ADSS offers copy trading through the prime and classic accounts, even though the broker is not a leader in social copy trading.

Mobile Trading

ADSS offers more than the usual MT4 offering the proprietary OREX platform for iOS and Android devices.

Pros of the OREX Mobile App

The OREX mobile app contains economic and general news with an earnings calendar.

The charting on the OREX app is excellent, especially when launched into a full-screen mode, which has 25 candlestick patterns and 63 indicators.

The market insight section of the OREX app contains sentiment analysis, including probabilities weightings – i.e. level of confidence for signal strengths – which is useful for new traders.

Cons of the OREX Mobile App

The OREX mobile platform is light on features, having minor bugs as well, with only the basic watchlist and research section matching the standard of industry leaders. An example is the sentiment analysis, which is available under the Market Insight section with other categories such as the Energy and Technology categories returning error messages.

ADSS Review of Customer Service

With customer care support available to clients 24 hours a day, five days a week, ADSS has a customer care team that is responsive and effective. The ADSS team can be reached via live chat, email, and telephone. Their customer care support team are known to be effective at resolving queries within 24 hours, most of the time.

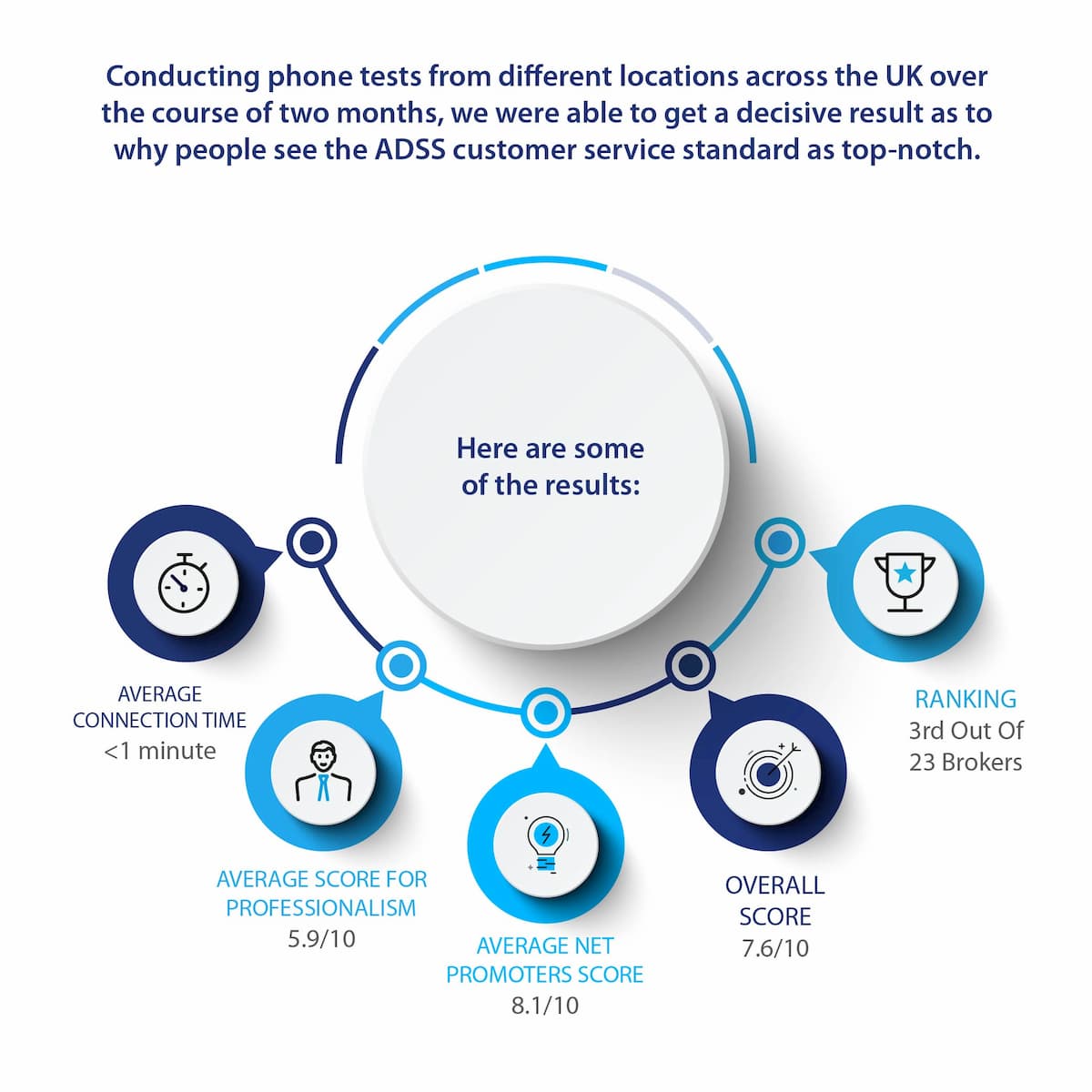

Conducting phone tests from different locations across the UK over the course of two months, we were able to get a decisive result as to why people see the ADSS customer service standard as top-notch. Here are some of the results:

- Average Connection Time: <1 minute

- Average Score for professionalism: 5.9/10

- Average Net Promoters Score: 8.1/10

- Overall Score: 7.6/10

- Ranking: 3rd out of 23 brokers

ADSS takes customer service very seriously, which is one of their strong points for driving their market competitiveness.

ADSS Review Final Thoughts

With the company’s retail trade section having the OREX Platform suite as a good foundation, ADSS has a standpoint which qualifies them as more than the typical MetaTrader brokerage, by offering extra add-ons for MT4 and providing Forex traders with 2200 CFDs and over 60 currency pairs.

The ADSS was founded in 2011 in Abu Dhabi with an initial capital of $400 million. Formerly known as ADS Securities, the company has since developed into a global brand with regulated entities in the UK, United Arab Emirates, and Hong Kong. The ADSS caters to its ADS prime in the UAE for clients in the Gulf and other countries, and the ADSS brand in the UK for citizens in the EU, whereas clients in Asia can make use of the Hong Kong unit of the company, which also offers securities that are exchange-traded as well as futures trading, with extra support in Singapore giving the company high regional coverage across Europe and Asia.

With all we have highlighted in our ADSS Review, it is evident that ADSS has a high profile in the market today with a decent reputation, which took some time and effort to build. The company is client-oriented and has a reputation for solving client queries within a short period of time.

Trading securities involves a high degree of risk for off-exchange derivatives, margin-based foreign exchange trading, and cryptocurrencies, including creditworthiness, limited regulatory protection, leverage, market volatility, or related instruments. It should not be assumed that the indicators, methods, or techniques presented in these products will be profitable or not profitable.

The content provided here should not, under any circumstances, be taken as financial advice of any sort. The information here has been well researched and is certified to be true. However, any financial advice should be sought from your financial advisor based on your personal circumstances.