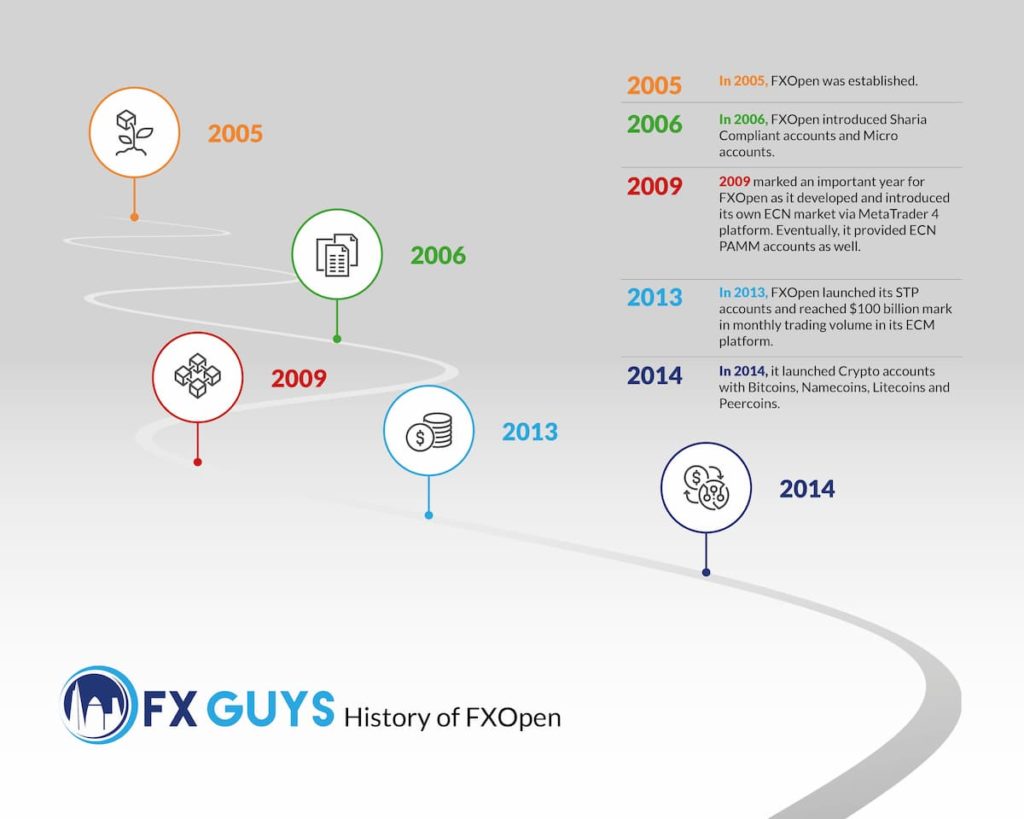

FXOpen was founded in 2003 by a group of traders as an educational center for technical analysis. Later, in 2005, it established itself as retail Forex brokerage. It allows trading into minor, major, and exotic currency pairs, crude oil, metals, natural gas, index CFDs, cryptocurrencies, etc. Our FXOpen review explains that they should be applauded for bringing FX trading to the masses by keeping its initial deposit at $1. Other companies had offered micro accounts with $50 as minimum deposits but FXOpen took the revolutionary step.

FXOpen became the first brokerage firm to offer the clients ECN trading via MetaTrader 4 terminal. It offers Investment accounts for several account types like Electronic Communication Network (ECN), Straight Through Protocol (STP), Crypto, Micro, and PAMM. Initially based out of Egypt, the firm shifted its headquarters to New Zealand. However, after the Financial Market Authority (FMA), New Zealand introduced some reforms, the company moved to the U.K. and Australia. To read the FXOpen review in detail, read further.

Summary of Regulatory Status

Currently, it comes under the supervision of The Australian Securities and Investments Commission (ASIC), and the Financial Conduct Authority (FCA.)

ASIC is amongst the most reputable forex regulators and provides strong protection from unscrupulous brokers to forex traders. Under ASIC regulations, FXOpen publishes a guide, which states exactly what the customers are signing up for. As per ASIC requirement, FXOpen is a member of a third-party organisation, Financial Ombudsman Services (FOS) Australia. FOS resolves customer complaints. A complaint against FXOpen by a customer is first addressed to FXOpen’s internal dispute resolution process. If the customer is not satisfied with how their complaint has been handled, they can escalate their complaint to FOS for an independent review. Whatever judgment is made by FOS, FXOpen has to follow it. Due to this, forex traders have protection against a broker acting fraudulently.

In the U.K., FXOpen is not governed by any such regulation. It is a member of The Financial Commission, which does not provide a dispute resolution mechanism. The Financial Commission cannot enforce regulations and is just a corporation.

The only time FXOpen has been reportedly fined was in 2011 because it was soliciting American customers without being registered with Commodity Futures Trading Commission (CFTC, the U.S.A.) Other than this, FXOpen has a clean sheet; without any evidence of scamming or unfair treatment of its customers. According to FXOpen review, it is fairly safe to trade with FXOpen.

Counterparty Risk

One of the most important parts of FXOpen review is the counterparty risk. Although FXOpen advertises in Australia that it operates a true ECM, its customers should know that FXOpen acts as the counterparty to their traders. This means that FXOpen is not liable to meet its customers’ financial obligations if it goes bankrupt. Their customers can lose all or some of their account balances. However, FXOpen reduces this risk by protecting its customer’s open trades with liquidity providers. It also maintains a minimum capital reserve defined by ASIC to mitigate counterparty risk.

In the U.K., the firm acts as a counterparty to all but ECN order customer trades, meaning customers will have to bear counterparty risk for non-ECN trades. However, FXOpen’s clients are protected under the U.K.’s Financial Services Compensation Scheme (FSCS.) The FSCS is the last compensation fund that a customer is eligible to if their financial service company fails to return client money during bankruptcy. The compensation can go up to $50,000.

In January 2015, during SNB Swiss franc, FXOpen temporarily stopped trading of CHF currency pairs. But it was also one of the first brokers that resumed the pair’s trading. Unlike other brokers who went bankrupt during this crisis, FXOpen sailed through without being significantly affected. FXOpen review considers FXOpen to maintain a strong position in similar situations.

What Is FXOpen’s Business Model?

FXOpen uses ECN business model in Australia and the U.K., which means there will be no intervention by the dealer in client trades. Many other brokers also use a similar model that serves to diminish the conflict of interest between them and the traders. The only difference with FXOpen is that it serves as a counterparty.

It is noteworthy that Micro accounts offered by FXOpen firms functioning outside of Australia and the U.K. operate under pure market maker model. This implies that traders are directly trading against their broker, and there is no mention of hedging trade with other counterparties in the customer agreement.

What Are FXOpen’s Account Types?

Another necessary aspect of FXOpen review is the type of accounts it offers to FXOpen’s clients.

- For traders who want to practice and achieve profits before risking real money, FXOpen offers demo accounts, which do not expire until thirty days of being inactive.

- FXOpen was the first brokerage to allow people with a minimum capital to enter into trading. An FXOpen micro account can be opened with just $1 with leverage up to 1:500. Due to lower minimum capital and higher leverage, FXOpen’s most popular trading account is its micro account. It is an account that matches orders internally while not connecting to a liquidity provider directly. FXOpen review considers this account prone to higher spreads and requotes. The spread starts at 2 pips but can rise up to 6-10 pips for dominant currency pairs.

- STP or Straight Through Protocol accounts offer ECN trading conditions while not associating trading costs. Although STP accounts have no commissions, the spreads starting from 1 pip go high during volatile market conditions. It also offers maximum leverage at 1:500. This account can be opened just for $10 and has a 0.01 lot trade size.

- The minimum deposit amount for ECN account is $100. Its trade size and maximum leverage are same as STP account, 0.01 lot and 1:500 respectively. Its spreads are 0.5 pips with $2.5-$5 commission per lot.

- The Crypto account offers a minimum deposit of $10. You can trade Bitcoin, Peercoin, Ethereum, Litecoin and Namecoin in pairs with RUB, USD and EUR using the advantages of ECN trading. Its maximum leverage is 1:3 and the minimum trade size is 0.01 lot. Its spreads are from 0.0 pips with 0.5% commission half-turn.

- FXOpen also has Sharia compliant trading accounts for Muslim traders. Islamic traders need to conform to certain moral and ethical standards listed under Sharia Law while investing in the markets. FXOpen offers specially customised accounts only for Muslims so that the guidelines under Sharia Law are met.

What does our FXOpen Review have to say about the Trading Experience?

1. Trading Platforms and apps

FXOpen offers several trading platforms like MT5, MT4, FXOpen mobile trader and Web Trader. This part of FXOpen review will help you to decide which platform to choose.

Amongst these, MetaTrader 4 is the leading platform for trading and has received prestigious awards year after year. It allows automated training as well as manual training. MT4 comes with a user-friendly interface, advanced charting package, various technical indicators, extensive back-testing environment, and multiple Expert Advisors. An FXOpen ECN trader can expect error-free and instantaneous order execution at adequate prices from more than ten banks and liquidity providers under MT4. FXOpen also offers Android and iOS mobile apps for permitting traders to execute, analyse and monitor trades from anywhere.

Some of its trading features are:

- Allows scalping

- Allows hedging

- Low minimum deposits

- Offers STP

- Offers negative balance protection

MT5 is an updated version of MT4. It has a similar user interface with new functions that provide traders with everything they need for lucrative forex trading. In FXOpen MT5, only ECN account is presently supported.

FXOpen also has a partnership with Myfxbook and ZuluTrade to offer advanced auto trading options to its investors. However, traders using these services can be scammed.

Myfxbook Auto Trade will help you if you have no experience in Forex trading. You will be getting help from traders with years of experience. There are several benefits:

- You pay commission for profitable trades only

- Only the accounts with a deposit of $1000 and three months of successful trading are included in the ranking of the strategies

- Graphics reflecting past trading results will help you to assess future strategies

- The presence of stimulation strategies and demo account help you in evaluating the service

- You can limit the number of transactions, currency pairs, lots, while also setting drawdown level, which when reached will cause the strategy to suspend

Zulutrade, on the other hand, is a service that allows traders to copy trades of inspiring traders for a fee. Its advantages are:

- You can simultaneously manage multiple accounts

- You can create the portfolio

- You can monitor the positions in real-time

- There is quick processing of orders between the provider and the receiver of a signal

- You will receive a fully functional thirty-day demo account after registration

Moreover, you can use the firm’s Virtual Private Sector (VPS) service for 1 month for free, if you maintain equity of $5,000 at the end of the month or have traded per calendar month volumes of $10,000,000.

2. Executing Trade

You can execute a minimum trade of 0.01 lot. Based on the account you open, this may vary. Because FXOpen offers STP execution and ECN, you can look for tight spreads with higher transparency over the price you are paying for executing your trades.

Compared to an ECN brokerage firm that benefits from a larger volume of trade and has a large capital with minimum trade requirements, FXOpen might have lower entry requirements, no commission, and smaller minimum trade requirements.

There are a number of risk management features like stop losses, control orders negative balance protection, etc.

3. FXOpen As True ECN Broker

FXOpen review considers FXOpen as a true ECN broker as your sell orders are filled on the offer and your buy orders are filled at the bid. This means that instead of paying for the spread, you can make it. It also means that you get to interact directly with other traders at whatever price you set, and it is not controlled or limited by the broker. You can decrease the spread if you want and can even put orders in the middle of the spread.

4. The Rollover Rates Offered By FXOpen

Also known as swaps, rollover rates are how much the trader will be debited or credited for positions that they hold overnight based on the interests rates those currencies hold. According to FXOpen review, these rates fall in the middle of the pack, not too low but not too high either. Every broker wants to earn profits, and after offering low commissions and great spreads, decent rollover rates are not a thing to worry about.

5. Slippage And Re-Quoting In FXOpen

Slippage means getting a different price than you expect. Traders have reported rare slippage with FXOpen. Requote refers to a situation where the broker offers a different price than your desired price. These prices are usually worse and affect trading.

6. The Spreads And Commissions Offered By FXOpen

FXOpen offers ECN accounts with highly competitive spreads. ECN account instead of being passed through a mediator who marks spread interacts straightaway with market liquidity. Spreads range from 0.1 to 0.4 pips during London and New York sessions. To compensate for small spread, traders pay a small commission per trade.

Although FXOpen review does not consider FXOpen’s spreads as the smallest, its commissions are the lowest, making the overall of the trade one of the lowest. Some brokers have comparatively lower spreads but a very high commission. For example: where a typical trader is charged $2.50 per $100,000 traded, FXOpen charges $1.50 per $100,000 worth trade.

Tight spreads and low commissions welcome day traders and scalpers. Longer-term traders and swing traders also benefit from lower spreads and commissions.

7. Client Support

FXOpen review considers FXOpen as a language-friendly broker as it supports several languages like English, Farsi, Arabic, Spanish, Turkish, French, Portuguese, German, Thai, Russian, Indonesian, and Malay.

It also has email support and live chat. The executives are quick to reply and resolve issues almost immediately. Some people, however, still complain about their customer support executives.

FXOpen Deposit And Withdrawals

Traders can fund their FXOpen accounts through several methods like wire transfers, local bank transfers, debit/credit cards, electronic payment systems like Skrill, Neteller, Payza, WebMoney, etc.

Withdrawals from account usually carry a fee. Wire transfer has a fee of 30 units of currency. However, these withdrawals are free in the U.K. Most forms of withdrawals charge a fee based on the percentage of withdrawal amount except bank transfers outside the U.K. FXOpen allows for withdrawals and deposits to be done for most of the trading currencies. Deposits are usually quick, many times instant whereas withdrawals take 24-48 hours.

E-wallets generally charge 2.9% to 3.9% on a withdrawal of $10,000. Credit cards also charge up to 3% based on your bank’s policy. These are suitable for small transactions.

Conclusion

The FXOpen Review rules in favour of FXOpen. Although some traders do not like to trade through FXOpen, its benefits keep on attracting new traders each day. For beginners, trading through FXOpen can be difficult. However, with practice, FXOpen proves to be one of the best Forex brokers. Its unique features like ECN helps a lot of busy traders to maintain lucrative trading. With an experience of almost fifteen years, FXOpen has established itself as a trustworthy brokerage firm. Its initial deposit standing at $1 has helped many traders to test the market before plunging into the market with huge capitals.