GKFX: Everything You Need to Know

GKFX Financial Services Ltd. specialises in offering an online trading program with varying trading services and spreads. Previously known as Smart Live Financial Services Ltd., GKFX was first established in 2013. Users can trade CFDs, commodities, spot forex, etc. The company is regulated by the FCA or Financial Conduct Authority in the United Kingdom and by BaFIN Germany.

It is represented in several countries like Poland, Russia, France, Holland, Greece, the UK, Germany, etc.

This GKFX review considers GKFX to be one-of-a-kind in the sense that this company provides various options to the traders, which are not offered by its competitors. This is why this young brokerage firm has managed to remain at the top.

GKFX’s unique aspect is that it is the only broker that uses MT4 (MetaTrader 4) for spread betting. Every other broker has MT4 support but only for spot forex and CFDs.

How Reliable is GKFX?

Many big fish in the forex industry choose to signup with brokers with big names primarily for peace of mind. And it is natural because if you know that your brokerage firm is an established one, it helps develop a sense of security and peace. It is because these firms are regulated by an agency in the countries of their origin.

However, trading with a prominent broker also means that you will never get personalised services. If you want to seek personalisation of services, smaller yet established brokers, such as GKFX, can offer better. Although GKFX is a fairly new company, it has established itself as a firm with incredible credibility.

GKFX is amongst the few small brokers that have been able to offer their traders the same security and peace that well-known brokers provide. GKFX is also regulated by not only one regulatory authority, but by five such authorities. In the UK, it is regulated by FCA, Japan by JFSA, Germany by BaFIN, Australia by ASIC, and Hong Kong by SFC.

Additionally, it offers excellent customer support to its traders. So, while using the services, you can be sure that any problem you have will be addressed. In GKFX’s headquarters located in London, there are more than 400 employees.

Moreover, the company operates in 22 other locations: Amsterdam, Beijing, Bucharest, Cairo, Dubai, Frankfurt, Hong Kong, Istanbul, Johannesburg, Lima, Madrid, Manila, Mexico City, Milan, Moscow, Paris, Prague, Santiago, Shanghai, Stockholm, Sydney, and Tokyo.

What’s more is that its website can be accessed in 30 languages, which is highly convenient for non-English speakers. GKFX boasts of offering traders with the immensely popular MetaTrader 4 or MT4 trading platform as well. The company has also collaborated with MYFX to provide its clients with a chance to use MT4 more deeply.

To conclude, this GKFX review considers this company to be fairly reliable.

Choice of Trading Platform

GKFX uses the MetaTrader 4 trading platform like most major brokers due to its popularity. MT4 is very intuitive and robust making it an apt trading platform for traders who wish to trade spot forex.

The company also offers an outstanding platform for conducting spread betting. GKFX is probably the only firm in the brokerage industry which provides spread better with all the advantages of a regular platform including MetaTrader 4 support.

Furthermore, traders are provided with an assortment of applications for several mobile devices such as smartphones and tablets. This lets the traders access the platform to trade whenever and wherever they want.

The MT4 MultiTerminal lets traders work with several accounts simultaneously, offering a dynamic platform to the account managers. It also allows you to place pending and market orders, view live market prices, view history and verify all equities and account balances in real-time.

If you want more exclusive options, you can use the premium MYFX platform with MT4 via a subscription fee. This will let the traders enjoy an enhanced trading experience because of increased features, such as one-click trade execution, risk per trade as % and $, profit/loss as pips and much more.

Thus, in this GKFX review, it is safe to say that the trading platform offered by GKFX is convenient and efficient for the majority of the traders.

Account Types

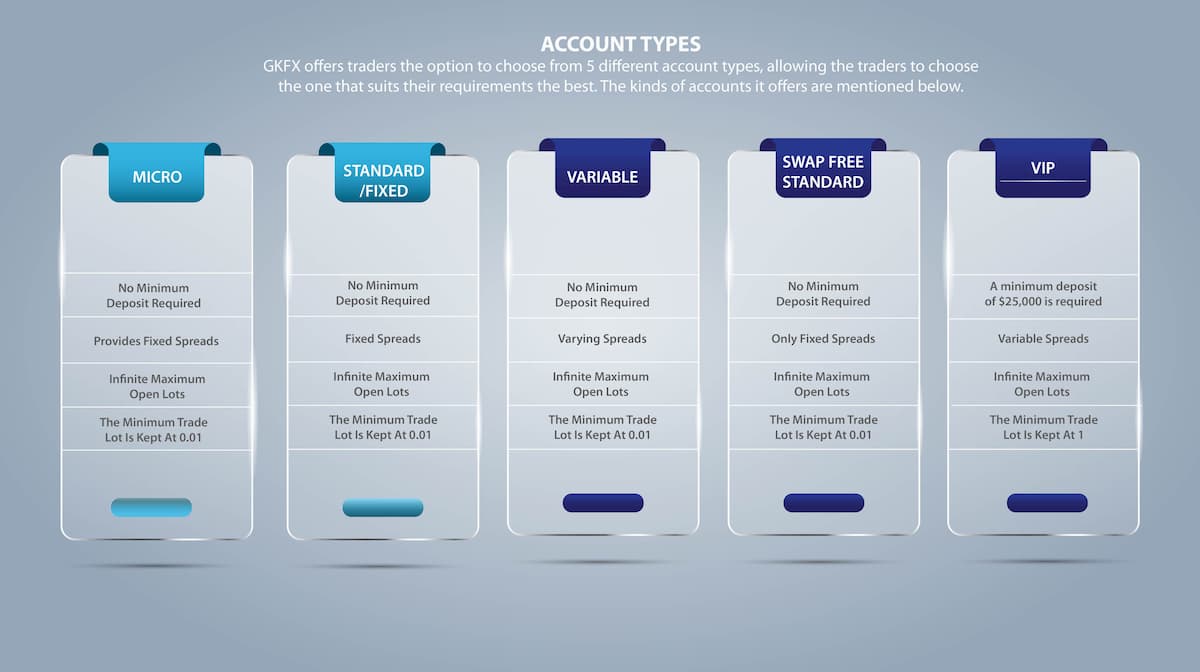

GKFX offers traders the option to choose from 5 different account types, allowing the traders to choose the one that suits their requirements the best. The kinds of accounts it offers are mentioned below.

Micro Account

- No minimum deposit required

- Provides fixed spreads

- Infinite maximum open lots

- The minimum trade lot is kept at 0.01

Standard/Fixed Account

- No minimum deposit required

- Fixed spreads

- Infinite maximum open lots

- The minimum trade lot is kept at 0.01

Variable Account

- No minimum deposit required

- Varying spreads

- Infinite maximum open lots

- The minimum trade lot is kept at 0.01

Swap-Free Standard Account

- No minimum deposit required

- Only fixed spread

- Infinite maximum open lots

- The minimum trade lot is kept at 0.01

VIP Account

- A minimum deposit of $25,000 is required

- Variable spread

- Infinite maximum open lots

- The minimum trade lot is kept at 1

If you want to try GKFX’s services, you can register for a demo account, which gives the trader access to the complete suite of services. Utilising the demo account, you can trade by using virtual currency in real-time. This way, you would not gain or lose any money. GKFX review considers this as a real plus point.

Deposit and Withdrawal Options

GFKS Prime fulfils international rules regarding anti-money laundering and, thus, does not allow funding of accounts by external or third-party sources. Each client needs to have KYC verification before the transaction can be carried out. For all payments, the trader needs to maintain at least 20 EUR/USD/GBP as a deposit.

All traders can withdraw or deposit from their accounts after logging into the safe MyGKFX section of its website. The transaction methods available are mentioned below.

- Credit cards: Accepted debit/credit cards include VISA Delta, VISA, MasterCard, VISA Debit, VISA Electron, Solo, and Maestro. This way, along with the e-wallet option, is the quickest method of GFKS Prime’s transaction. All successfully authorised transactions are credited to trading accounts instantly.

- Bank wires: This offers higher withdrawal and deposit limits than cards or e-wallets. The limit is set at 50 units and above the account’s currency.

- E-wallets: E-wallets like Neteller, Sofort, and Skrill are accepted. You can use Sofort for online banking transfers.

Safe and multiple transaction options get a thumbs up in this GKFX review.

Spreads and Fees

GKFX takes the fees from the spread like most brokers. Spread is the difference between the sell and buy price of an instrument. GFKX’s minimum spread is 1.5 pips for trading EUR/USD, however, the spreads vary based on the type of account.

- In the swap-free account, a fixed spread is set at 2.5 pips.

- In the micro account, the spread can be set at a minimum of 1.5 pips.

- In the standard account, the minimum spread is set at 1.2 pips.

- In the VIP account, the minimum spread rate begins from 0.6 pips.

Features

- Traders can use Trading Central Analysis that provides market knowledge and depth after years of experience gained on the trading floors of several banking institutions. The Trading Central is listed with the SEC or the U.S. Securities and Exchange Commission as an Investment Adviser.

- The daily market reports offer a general overview of the trading market as well as actionable insight. You can subscribe to reports to attain daily newsletters on trading economic events and opportunities that could affect your trades. This is extremely beneficial for beginners.

- Autochartist is a trading tool that scans trading markets automatically for the purpose of real-time trading opportunities. Additionally, it creates 3 market reports each day with an abstract of popular markets. The trader can retrieve it through the web trader or MT4 trader plugin.

The above-mentioned features are beneficial for every type of trader and, thus, the GKFX review considers GKFX to be beneficial for its clients.

Research and Education

GTFX’s research is outsourced to Trading Central and since this broker is new, it is acceptable. While GKFX does not offer the benefits of in-house research, its external offerings are remarkable.

You can use a trio of calculators – margin calculator, profit calculator, and currency converter calculator, however, they are not popular amongst traders. The margin calculator can be a part of an effective risk management protocol while the profit calculator may help with take-profit/stop-loss placements.

An economic calendar is offered a well, but during our GKFX review, this page was blank. We believe that this was due to a technical error as there is a well-presented tutorial regarding how to use the calendar.

Education

GKFX provides its educational section primarily via video lessons. There is an extensive range of videos, but not every video was available to watch, which was disappointing. A few MT4 tutorials feature a person who claims to be a GKFX team member.

But the videos have been made using a computer-assisted technique where the presenter is visible only for a few seconds, and is either edited into the virtual reality background or has been edited out. In fact, many videos no longer exist in the library, probably because of a technical glitch.

GKFX also provides another valuable service – webinars. However, at the time of the GKFX review, there was not a schedule of any webinar. There could be past webinars posted on its website instead, asking traders to subscribe to its official YouTube channel.

Lastly, GKFX also has a glossary, which covers trading terms, as well as economic indicators that are present under a different section.

Customer Support

GKFX customer support is available deo Sundays to Fridays from 7 AM to 6 PM GMT. You can reach out via email, phone, or message. You can also use its live chat function. Another praiseworthy element is that its customer support as well as website is available to its users in 30 languages.

This means that even if your first language is not English or you do not know English, you can freely contact GKFX customer support associates and resolve any issues. However, with the level of services they are providing, as per this GKFX review, you should not need to contact them in the first place.

The Final Verdict

GKFX provides 386 instruments to trade along with 53 currency pairs. Being not even a decade old and regulated by FCA, GKFX is doing a noteworthy job in the industry. Its traders can also choose from a number of facilities beyond their basic set of tools.

This GKFX review considers GKFX to be sound with ample growth potential. The brokerage firm suits not only beginners but experienced traders as well. Its MetaTrader 4 platform is highly popular amongst the traders and with the premium MYFX platform, traders can make use of exclusive features.

Lastly, its customer service with live chat, email, message, and phone as well as 30 language options make GKFX easy-to-use for people who do not know English. In conclusion, GKFX is a reputed firm that offers numerous benefits to its users.