Pepperstone Review: A completely unbiased broker overview

Pepperstone are a respected and well-known retail forex trader, mostly known by many for their revolutionary approach to market making, which has seen them expand operations across the globe, growing to a level that has surpassed the competition.

One reason for our Pepperstone review is to ask ourselves a simple question: Are they still the best around today?

In the Pepperstone review, we believe this question will be answered, as we are going to take a good look at this broker, its trading technology, instruments, and fees. We will also give you some tips on how to make the most of the Pepperstone trading platform.

In 2010, Pepperstone was founded by Joe Davenport and Owen Kerr in Level 16, Tower One, 727 Collins St, Melbourne, Australia.They have other offices in countries including Thailand, UK, and U.S.A. Pepperstone offers contracts for difference trading in over 60 countries around the world, with over 60 forex pairs and many other assets classes to trade.

What’s more, Pepperstone were one of the first brokers to institute a No Deal Desk model, which allows you to eliminate any conflict of interest, providing liquidity for clients through connections to the interbank markets. With the introduction of the model, this broker has expanded exponentially, with over 75,000 traders processing an average of $5.8 billion daily.

So, is Pepperstone Safe?

This is one of the most important questions for any prospective broker to ask before venturing to use this platform to trade. I would say Pepperstone is one of the best trading platforms because it offers many client protection options as well as extensive regulatory coverage.

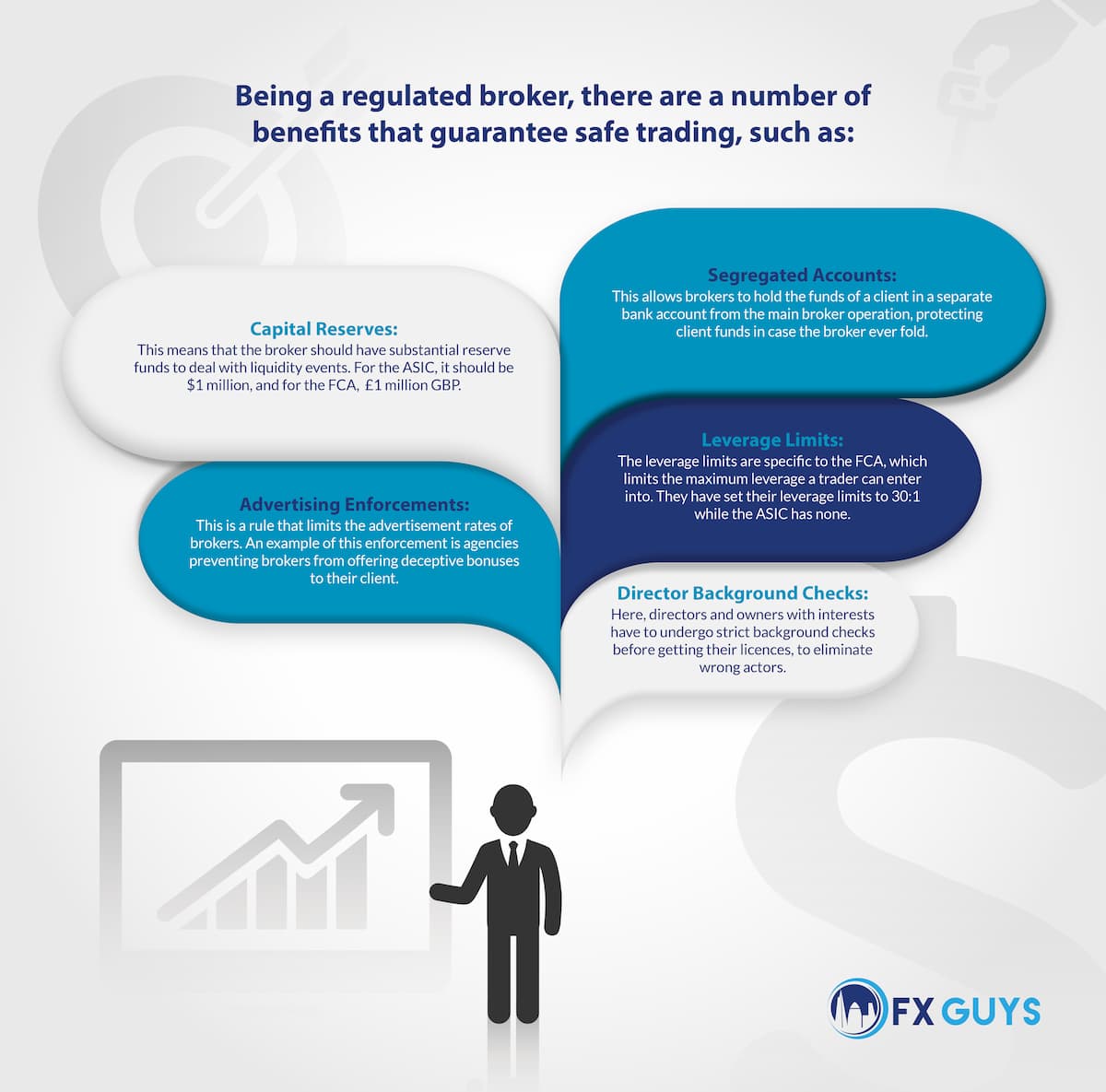

Pepperstone has regulatory licences with the Australian Securities Investments Commission in Australia (ASIC), and the Financial Conduct Authority (FCA) in the UK, amongst other countries.

For the UK licences, client accounts are covered for up to £50,000 if Pepperstone goes under for any reason, so you have a government agency to turn to if you have any problems with your broker.

The ASIC licence covers clients from South Africa, New Zealand, and Australia, while the FCA licence, though based in the UK, covers all traders based in Europe because of the markets in the Financial Directive, which allows European Regulated Brokers to offer services to EU members.

Other Protections

Apart from protection from licences, there are other safeguards in place to protect clients from any issues with brokers, such as:

Independent Auditing: Pepperstone offers a level of transparency not offered by other brokerages, retaining the independent auditors they began with Ernst and Young.

Top-Tier Banks: As highlighted earlier, Pepperstone keep their clients’ funds in a segregated account, but these segregated accounts are also held in trust accounts at trusted banks in the UK and the National Australia Bank in Australia.

Liability Insurance: Liability insurance from Lloyds of London means that Pepperstone is always covered from liquidity in case of any unforeseen circumstances.

One thing also worth mentioning with the no dealing desk policy offered by Pepperstone is that clients’ orders are not being monitored by anyone, not even Pepperstone.

Assets & Leverage

As we previously highlighted, Pepperstone offer CFD trading on over 60 different forex pairs, allowing you to also trade commodities, indices, and futures. Another great thing they offer is cryptocurrency, trading in bitcoin cash, Ethereum, Litecoin, and Bitcoin.

The maximum leverage achievable on your account is 500:1 or 30:1 if you are in the UK. This maximum leverage is applicable to the forex, precious metals, and energy assets.

Nevertheless, the maximum leverage achievable on the Index CFDs is 200:1 on some of the bigger indices and 100:1 on the smaller ones. As for soft commodities, it is 50:1 and cryptocurrency has a leverage of 5:1. With all the leverages mentioned here, we can see that maximum leverage levels depend on the asset you are talking about. Some pairs are more unpredictable than others, hence commanding lower limits.

Pepperstone Fees and Spreads

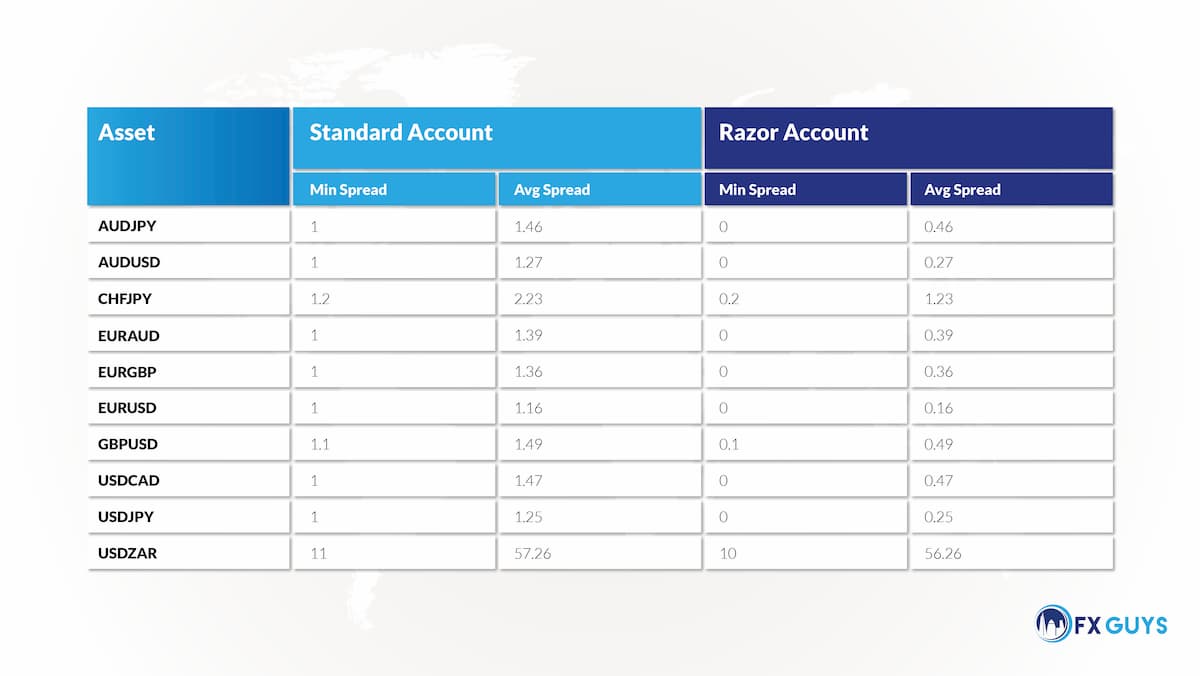

One major factor traders put into consideration when trading CFDs is brokers’ fees. This is because spreads are charged based on leveraged positions, which are often bigger than the initial margin. Pepperstone, however, thrive on low fees and spread prices and, given their great approach to matching client orders, they have some of the lowest spreads in the industry.

The spreads and fees you get depends on your account type; something that is explained in greater detail below:

The Razor account gives lower spreads for most assets, with an extra fee called the “Lot commission” – a commission charged based on the number of lots you trade. Pepperstone do not charge a withdrawal or deposit fee except if you use a debit card, which would possibly incur third party fees.

However, they do charge an overnight fee on your account, which is the financing charge that makes up for the interest rate differential between the two forex pairs. This could be a charge or a credit depending on interest rates in question. The overnight fee will be shown to you on the platform before you place a trade.

Account Types

With Pepperstone, there are three main account types: the Standard account, the Swap Free account and the Razor account. Apart from the fees charged on these accounts, there are few differences between them. All these accounts allow you to hedge, scalp, and develop your own EAs. With the negative balance protection on your account, you can never lose more than you deposited.

Talking about deposit size, Pepperstone’s minimum deposit is $200, which is in line with a number of CFD brokers for other European counterparts, such as IQ option, which offers a minimum of $10. For those high-volume active traders, you can earn a refund on the lots, with tier 1 earning about A$1 per lot and tier 2 dependent on momentary offers. There are other benefits that come with an active traders account, such as VPS hosting, Qantas Frequent Flyer Miles, and priority customer support.

Pepperstone Demo Account

When we want to give a new broker a chance, we would prefer to try first it by using a demo account, which Pepperstone offers. The demo account on Pepperstone is a no-obligatory account, which gives you the liberty to trade as you want. With this demo account, you can get a feel for the broker, spread, and overall platform in a cool and calm environment.

To trade on Pepperstone, you will need to register for an account, download the MT4 trading software, and start trading. The demo account has $50,000 in demo funds available on registration. This demo account, however, has a 30-day limit, giving you an option to continue with real funds afterwards.

Customer Support

Forex traders understand the importance of customer support and for Pepperstone, their customer support is one of their selling points. Their customer care support was, and is, so good that they have won a number of awards for the quality of their customer support.

First, their live support is always available 24/7, with their chat platform always online, ready to help tackle any challenge. For those of us who prefer to tackle issues on the phone, you can get in touch with them internationally via the number +61 3 9020 0155, while, for those in Australia, the number is 1300 033 375. All the support lines are multilingual since the first language of most traders is not English. For anyone who wants to deal directly with the brokers, you can find their numbers and office locations on their contact page.

Finally, if you want to deal with them via email, they can be reached on support@pepperstone.com.

Pepperstone Trading Platforms

Moving to one of the most important aspects of the Pepperstone review, we look at the trading technology. With Pepperstone, there are three trading platforms:

- MT4

- cTrader

- MT5

Let’s take a look at them one by one.

MT4

MT4 is one of the most popular third-party trading platforms on the market today, which many brokers make use of. It is an important platform because it is used for advanced trading strategies and was developed by MetaQuotes, an independent software licenser, for use on web, mobile, and PC.

The array of charting, updates, and functionality on the MT4 interface has made it a traders’ favourite for a long time now. The MT4 platform is so versatile, you can develop your own trading algorithm, known as Expert Advisors, a coded proprietary programming language for the platform called MQL4.

Even though you can use this software through the web-based interface, you should download the PC client because there could be order latencies as they are placed through the browser.

MT5

The MT5 is a new generation trading software, also developed by MetaQuotes, which is totally different from the other MT4 platform and more technical. When making use of the MT5 platform on Pepperstone, you will have access to other new instruments with advanced programming language in MQL5, an object-oriented language.

With this platform, you have the chance to see the market depth of the order book, which is a great way to see how much liquidity there is for a certain asset at different prices. Currently, the MT5 platform is only windows- based due to the complexity of the platform.

cTrader

the cTrader platform is the most advanced platform on Pepperstone, which allows you to access their best liquidity at the broker. Despite the technology, it offers a really user-friendly interface. It also has extra features such as different presets and detachable charts, which make multiple screen trading easier. With the enhanced ability of the charts, you have control over your order management.

Another important thing to note about cTrader is the cTrader algorithm, which allows you to code your personal algorithms and bots. This algorithm is developed in C#, which gives you an array of tools to help you refine your scripts, including their intuitive back-testing functionality. At the moment, cTrader is only available on Windows and the web, with no mobile application.

Mobile App

On-the-go traders always love to monitor their positions so they can trade when they need to, and the Pepperstone platform offers two mobile applications.

First is the MT4 mobile app available on the iOS and Android platform, which is the most sophisticated trading app on these platforms, downloaded thousands of times. The majority of the feedback from users who have downloaded the app have been positive, showing a good user experience.

Since this app connects directly to your MT4 account, you can use it to monitor your indicators and live EAs, but one thing to note is that your technical analysis may be difficult because they are not always as effective on mobile screens as they are on the web.

Next is the cTrader mobile app, which helps you monitor your account just like the MT4 mobile app. It is only available as an .exe file, which you can download on your phone.

So, is the Pepperstone mobile trading app safe for trading?

Yes, but one thing to bear in mind is the fact that mobile trading is not as effective as running it on the web or desktop. Furthermore, there is likely to be an order latency due to the use of mobile networks.

Funding and Withdrawals

Pepperstone provides different funding options, where you can have your account denominated to your local currency options, including USD, AUD, SGD, HKD, CAD, CHF, JYP, and NZD. This broker has many funding options, which include debit/credit cards, broker-to-broker funding, international wires, local bank transfers, and PayPal.

Withdrawals

For withdrawals, Pepperstone expect you to submit your request before 21:00 GMT for it to be processed that day. If your account is funded with a credit card, you can get the same amount back to your account up to 60 days after initial funding. The balance would also be sent to a bank account with the same name as your trading account.

Bank funding also goes through the same process, but it only takes 3-5 business days to get to you.

Education and Resources

When a broker includes some educational materials in their content, it means they put their back into it. At Pepperstone, you have standard materials such as webinars, FAQS, and trading guides to help you understand, and make the best of available resources.

VPS Hosting

For those of us who would like to develop our own EAs and bots, you might need to invest in a VPS so you can keep things running with almost zero downtime. This is good because when you set up your EAs in a data centre, you have reduced latency with a connection speed faster than your normal internet. The VPS providers used by Pepperstone include FXVM and New York City Servers.

Conclusion

With Pepperstone, you have one of the most trusted and fastest growing forex brokers in the world. Through the use of co-location agreements, and high frequency trading technology, Pepperstone stands out amongst the rest.

One thing that is constant with our Pepperstone review is their need for constant evolution, which makes them one of the best today.

So, is Pepperstone for you?

We cannot tell you to use this broker or not, as that is up to you. But when it comes to the services rendered by Pepperstone, this broker should be one of the most likely candidates for you.