As a trader in the financial market, it can be challenging to find a broker that suits all your needs, and most of the time, you have to visit brokers’ websites to make sure they have what you need. Here, we are giving you a Think Markets Review, giving you a breakdown of the necessary information on the broker, which will help you decide whether to make them your personal broker.

ThinkMarkets, formerly known as ThinkForex, was established in 2010. The ThinkMarkets company today is regulated in Bermuda – Think Capital Limited, Australia – TF Global Markets Pty, and the UK – TF Global Markets Limited. ThinkMarkets offers CFD and forex traders access to 38 forex pairs and close to 200 CFDs, which includes nine cryptocurrency CFDs.

ThinkMarkets Safety

ThinkMarkets is an average risk broker with an overall trust score of 77 out of 99. ThinkMarkets is not a publicly traded broker and does not operate any banks. ThinkMarkets is authorised only by two Tier-1 regulators:

- Financial Conduct Authority (FCA)

- Australian Securities & Investments (ASIC)

Commissions & Fees

The commissions and fees paid on ThinkMarkets vary depending on the account type you choose when you sign up. This broker can be classified as having fees that are much more than the industry average.

Considerations

- ThinkMarkets advertise only their lowest spreads, without providing an average spread value, which makes it difficult to make an even comparison with other brokers.

- The lack of an average monthly spread by ThinkMarkets makes it challenging to provide a clear picture of how its forex spreads average out over the full calendar month, as it has a competitive FX pricing on daily charts. This is something that should be changed.

- ThinkMarkets do, however, publish an average spread for specific instruments such as CFD indices.

- ThinkMarkets also provides market execution as its main attraction as an agency broker. This can lead to positive or negative slippage as traders are not given a trade based on the amount they entered. ThinkMarkets has a dealer licence in the UK, which is limited only as a match-principal. In Bermuda and Australia, the brand follows a similar method although it may take some risks as a dealer when required.

Benefits

- ThinkMarkets offers three types of accounts and a separate account type for its Trade Interceptor Platform offerings.

- For the Standard account, the minimum deposit is $250, and this comes with a broader spread, no commissions, and can be used on MetaTrader4.

- The Pro account has lower spreads compared to the three units per side commission, the standard account, or the equivalent to the $6 RT per standard lot and has a minimum account balance of $2,000.

- The VIP account is comparable to the Pro account, where the commission is negotiable based on the client, making this a good option for active traders. It is not available for the Trade Interceptor accounts.

- ThinkMarkets offer bankruptcy insurance for eligible clients who deposit more than $50,000 in the UK.

ThinkMarkets – Tools & Platforms

ThinkMarkets provides a trading experience that surpasses the traditional MT4-only offering. This makes it a desktop download-only platform, meaning that it has no version for browsers.

Considerations

- The platform has no web version, leaving the mobile option as the only alternative to the Interceptor desktop.

- Automated trading algorithms are not supported, which leaves only the backtesting option on the Trade Interceptor platform via the Gym feature.

Benefits

- ThinkMarkets offers two platforms for trading: the MetaTrader 4 and the Trade Interceptor platform – desktop installation.

- Even though the Trade Interceptor software might be a bit simple compared to other competitors, the available features are well structured and balanced, making it neither too complicated nor too simple. This essential and useful interface has brought about a lot of positive user experience from clients.

- The ThinkMarkets charting is clean and comes with around 102 indicators, 12 chart types and 54 drawing tools and icons. One good thing about the interface is that once indicators are added, they remain there by default on every instrument opened in a new window. The layout of a chart can also be saved as a template, which is comparable to the MetaTrader platform.

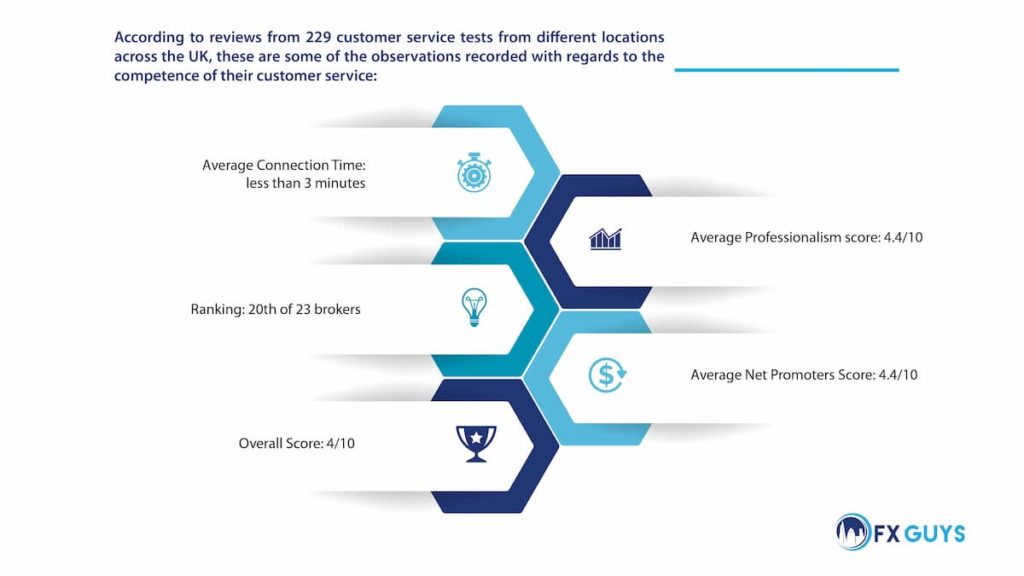

Think Markets Review – Customer Service

ThinkMarkets – Research

Generally speaking for this Think Markets review, ThinkMarkets has a diverse selection of CFDs and forex research but does not have the variety of tools and depth to compete with the industry leaders. When it comes to research, they do not have the depth to keep them in the ranks of the industry leaders, leaving them in 16th position out of 28 brokers.

Considerations

- The overall quality of research produced is average.

- Adding stock screeners and heatmaps to their research offerings would go a long way.

Benefits

- The research team of experts produce many blog posts daily, all of which cover fundamental and technical news analysis across the CFD and forex markets. It also has an economic calendar powered by FXStreet.

- There are news headlines provided by FX Wire Pro Stream for clients within the Trade Interceptor platform. Also, ThinkMarkets integrates AutoChartist (a popular pattern recognition software) for exploring trading opportunities – this tool is only available for clients who have no less than $2,000 in their account.

- There are many other research tools, including the MT4 Super, developed by FX Blue LLP, providing many indicators and trading tools that traders can use to customise their default MT4 platform setup.

ThinkMarkets – Mobile Trading

Using the ThinkMarkets Trade Interceptor app, many things qualify the app as perfect. Alongside the MT4, ThinkMarkets provides a mobile offering that is competitive and very useful for CFDs and forex traders. This is a very positive aspect of the Think Markets review we did.

Considerations

- There are no considerations for their mobile trading at the moment.

Benefits

- The Trade Interceptor app has a good range of features, which you can find in the more section, including the trend risk scanner and the economic calendar.

- There are 11 chart types to choose from, with 57 drawing tools and 102 trading indicators. The mobile experience is very similar to the desktop version of the platform, something that is not common but is beneficial to traders.

- The Trade Interceptor app might look simple and easy on the eye, at first sight; however, there are advanced features and settings that can be adjusted to fit the client’s specifications. For example, clients can change the view of their charts so they can view four charts at the same time – something not common with the mobile experience.

ThinkMarkets Review for Offering of Investments

The table below highlights the various investment products available to clients on the ThinkMarkets platform:

Features | ThinkMarkets |

Cryptocurrency traded as CFD | Yes |

Forex: Spot Trading | Yes |

CFDs – total offered | 192 |

Cryptocurrency traded as actual | No |

Currency Pairs (Total Forex Pairs) | 40 |

Social Trading/Copy Trading | Yes |

Other Important Notes to Consider for the Think Markets Review

When the value of an account is equal to half of the used margin, liquidation calls are triggered, which means that the free margin is allowed to move to a negative point equal to half of the margin amount used – before the close of all trades. This is a preferable option compared to brokers that trigger a margin call sooner, such as when the available margin reaches zero – that is when the value of the account is equal to the total of the used margin.

ThinkMarkets followed the industry trend in 2017 and began offering cryptocurrency CFDs, launching nine pairs against the US dollar, including Bitcoin Cash, Bitcoin, NEO, Bitcoin Gold, Ethereum, and Ripple. It is worth noting that ThinkMarkets cryptocurrency CFD contracts expire weekly, limiting the appeal to long-term investors.

ThinkMarkets also has a blockchain mobile app known as TradeConnect, following the Initial Coin Offering (ICO) of the ThinkCoin Cryptocurrency project, which is aimed at building a smart contract-based exchange and is a member of the ThinkMarkets Group.

Final Thoughts

Apart from pricing, ThinkMarkets’ main highlights include its cryptocurrency offering and its Trade Interceptor mobile app. Apart from this, the only negative aspect of this Think Markets review is the struggle to provide enough value to contend with the best firms in the forex industry.

Trading securities involves a high degree of risk for off-exchange derivatives, margin-based foreign exchange trading, and cryptocurrencies, including creditworthiness, limited regulatory protection, leverage, market volatility or related instruments. It should not be assumed that the indicators, methods or techniques presented in these products will be profitable or not profitable.

Looking at this, the content provided here should not, under any circumstances, be taken as financial advice of any sort. The information here has been well researched and is certified to be true; therefore, for any financial advice, you need to seek the help of your financial advisor based on your personal circumstances.