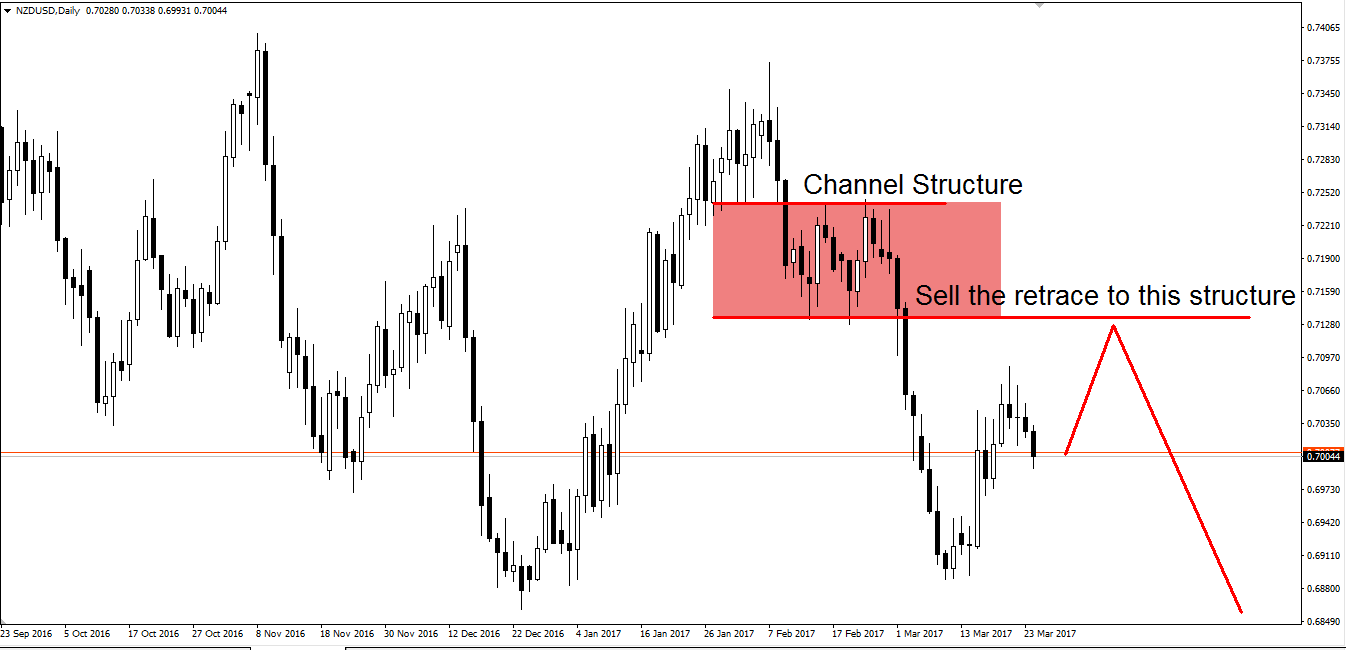

In the previous post, we identified a rounded retest as a key zone to do business at. The following is very similar.

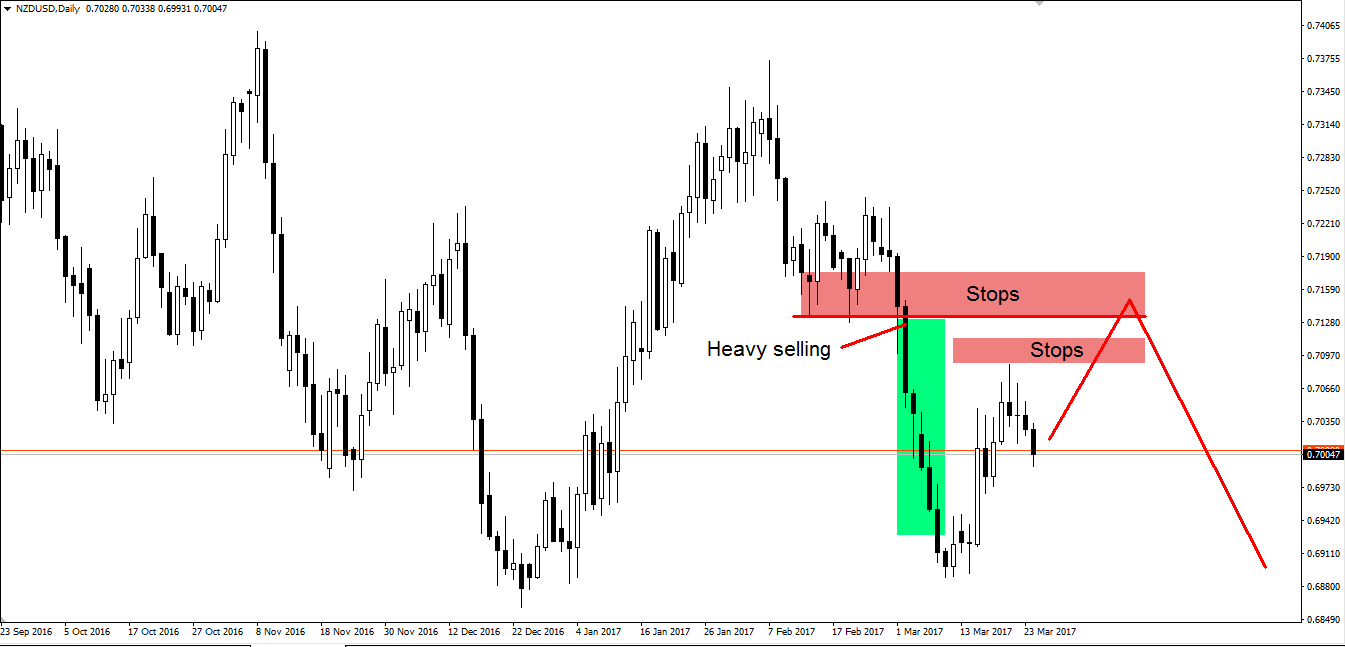

Here, however, we look for moves to accumulation/distribution (in this case distribution) structures that have come off of recent lows/highs to buy or sell into. Price tends to always gravitate back toward these structures for two reasons.

Firstly, there are resting stops on the break of the structure that the market would like to hit. These stops act as liquidity for large orders to re-enter the market with (less slippage) since there are ‘free’ buy or sell orders to match with the sell or buy orders (see our article on liquidity and what this means if you don’t understand this).

Secondly, the market always wants to solidify its price discovery process – this isn’t a science, just something that we have observed over the years. This therefore means that key structures act as magnets. Remember in the previous article I mentioned that I like to think of support and resistance as price interest zones? This is the reason as to why.

In this (will be link) article, we explain full Wyckoff schematics and why they are so important to understanding price and sentiment breakdowns.