Everything you need to know about swing trading

There are many revolutions that today’s modern world has brought about, but the platform that has been influenced the most is ‘trading’. As you can already see, the trends, paradigms, and goals of businesses are constantly changing over time. Today’s trading platform demands much more than the basics of commerce and business. This is exactly where the role of the ‘right strategy’ comes in. With the business environment getting increasingly saturated, traders are coming up with better trading tricks and tactics to become a strong part of the competitive world. In order to determine the upcoming direction of any business venture, it is important that you understand where exactly your position is in the current market.

The right strategy will help you to spot the weaknesses, strengths, threats and opportunities, and drive success more than ever before. So, here, you will be introduced to one of the most prevalent strategies of business today: swing trading. It is a popular concept, but that does not have to mean that we will all be familiar with it. In case you are wondering what is swing trading and how it works, here is some information for you. The information in all stages regards the ins and outs of swing trading that will help you understand the underlying aspects of the stock trade strategy and implement it like a pro!

A simplified introduction into what swing trading is

Swing trading is a popular form of active trading and is a business strategy that business heads use to buy stocks. Traders usually search for intermediate-term scopes using various methods of technical analysis. Technical analysis is one of the most prominent facets of a swing trade based on which moves are made and which decisions are taken. Usually, swing traders evaluate the business on the basis of risk and reward.

How exactly does the swing chart work? Will it work for you?

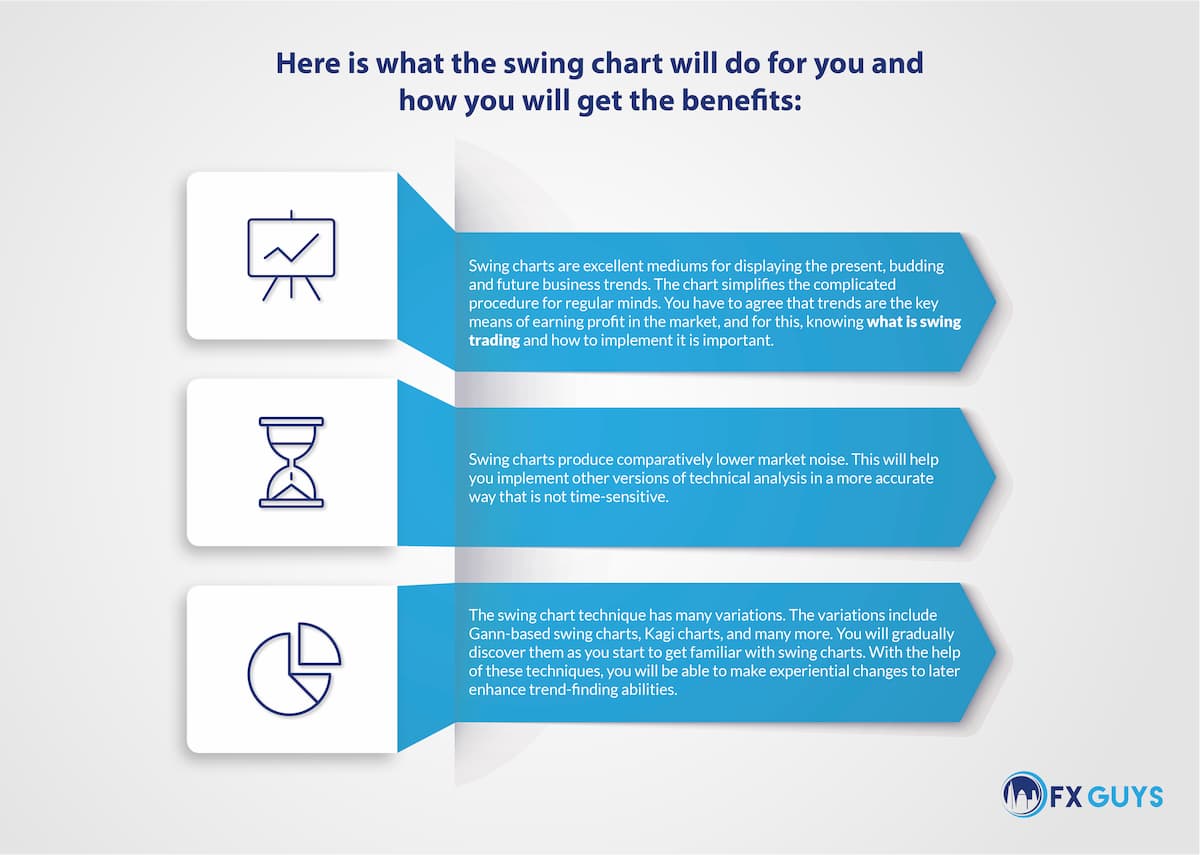

Swing trading is becoming highly prevalent in today’s market for many different reasons. But one of the main reasons why so many business heads are ready to use it are the strong trends being exhibited by stocks. What the swing chart technique basically does is determine the trends.

What does implementing the swing strategy require?

Now that you are aware of what is swing trading, let’s proceed to the implementation of this particular tactic. Choosing a stock trading strategy that is apt for your business is important. The strategy needs to fit your business goals specifically or it will just be like throwing a dart in the dark, and you definitely do not want that! Some people choose various stock trading methods as per their financial goals. Statistical methods, fundamental value trading, and pattern trading are some of the examples of the popular hard-core stock trading strategies that business individuals use nowadays. Swing trading is just another method among them.

The main trade-off for this particular business strategy compared to the other trend strategy is that it requires much more activity on the part of the trader in order to generate profit. The system of entry and exit might require you to look at intraday price rates to make an entry or exit decision based on your system.

The basic advantage of trading price swings is that the trade turnovers occur more quickly than those of trend trading. Thus, there is a lower profit that you return at the end of the trading process prior to closing it out. This can feel quite rewarding; however, it does not indicate that you will earn more profit than when trend following. The aspect that will determine your earnings is your trade system development effort.

Based on the trading signals that are being utilised, the swing trading system might have a comparatively higher reliability than that of the trend following system. This indicates that you will need to be right more often regarding your predictions, guesses, and decisions; however, the average profit amount per trade shall be lesser than with the typical systems of trend following.

As you can see, swing trading needs plenty of tactful and calculated activities. This requires expert knowledge, insight, and experience for the best possible ROI. In the majority of the cases, many organisations make the swing trading system mechanical. Mechanical swing trading is adopted in the initial stage, as it offers more accuracy and speed to a business venture by keeping psychological and emotional biases at bay. Keep scrolling to find out more about what is swing trading.

How to design a swing chart that will work for your business

Swing charts are probably the most fundamental forms of technique used in swing trading. This chart basically comprises bar charts that represents the behaviour and trend of price within a given period of time. If you are a technical trader, you have definitely come across a bar chart at some point in time. The vertical strokes stand for the price ranges, while the peg that is placed on the left stands for the opening price. The peg on the right stands for the closing price, within a given time period.

There are several different ways for designing a swing chart utilising the highs and lows. Here, we are going to consider the Gann swing charting strategy. For the Gann swing chart, you will need to consider four points in total. The up day, down day, inside day, and outside day are the four points in the graph you will need to keep track of to create a successful swing chart using the Gann method.

To get a detailed update of how to construct or design a swing trading chart, you might look at the online tutorial sites that explain what is swing trading along with its processes of implementation. If that is not adequate, you can seek professional assistance.

The ins and outs of using swing charts

Here, we come down to the practicalities of using swing charts, which explain more than what is swing trading. There are several ways by which you can use a swing chart:

Viewing the overall trend of equity or market trend

Trends can easily be differentiated simply by looking for higher highs as well as lows. You can identify that by the staircase-like patterns on the chart. You can also identify that by creating trend lines.

Position take-profit and stop-loss points

The previous highs can be utilised as the take-profit points. On the other hand, the previous step bottoms can be utilised as movable stop-loss points throughout a particular trend.

Application of technical analysis methods that are not sensitive to time

Application of non-time-sensitive techniques can help you forecast where exactly the price rates are heading, or it can aid you to place more efficient stop-loss and take-profit levels. Some of the best examples of non-time-sensitive techniques include Elliott Waves and Fibonacci levels.

Creation of price channels

Creating price channels is the next method of using swing charts in swing trading. It is mainly done by connecting and developing consecutive lows. It can significantly aid in predicting prices, placing stop-loss points and moving take-profit, or can aid you in adding a particular position in a timely way. Placing the lines that connect the highs with highs, along with another line connecting the lows with lows, develops a channel via which the price moves.

These can be developed by connecting consecutive highs and consecutive lows. This can help predict prices, place moving take-profit and stop-loss points, or help you liquidate or add to a position in a timely manner. Placing lines that connect highs to highs and another line connecting lows to lows creates a channel through which the price moves.

In what ways is swing trading different from the idea of intraday trading?

Swing trading and intraday trading are both prevalent terminologies in the world of stock market. This is why many tend to confuse these terms. However, there are two significant differences between the terminologies.

In the case of swing trading, shares are usually detained overnight or for many days or weeks. In contrast, in the case of intraday trading, stocks are usually sold in minutes or prior to the market closing time.

But nowadays, in the case of intraday trading, the stocks can be held overnight and if there is any significant news post-closure of the market, then you can rest assured that the stocks are safe from risks. When you are into swing trading, prime time or overnight news can lead to unpredictable situations and may well affect the stock prices.

Some great tips for choosing the apt stocks in swing trading

Just tapping into what is swing trading and how to implement it is certainly not adequate. You need to have a smart mind to compete effectively with your neighbours, and for that you will need to choose the right stocks for swing trading. Here are some quick tips that will help you:

- Keep an eye on the calendar for trading prospects

So the first move is to keep an eye on the calendar if you are short or long-term trading. While the price action is more vital than news, sometimes news can drive greater price action. It is always wise to know if your name is reporting any earnings; if you have executives who are appearing on the television or at conferences. Know if your products are being unveiled and being affected by the economic news.

- Know about your usual holding time

Holding time is very important when you are working with swing strategy. Choose the stocks in order to trade them up with the holding time you have set. It is suggested that you take a good look at your trading history in order to find out the specific time frames of the trades that are most profitable to you. If your time frame is one month then it is imperative that you pay attention to the stocks that make the larger moves within that particular time frame. A similar technique is to be applied for all other time frames.

- Don’t let the hype shadow your views – focus on price action

A large percentage of swing traders pay attention to enterprises that are always in the limelight. Whether it is press releases, conferences, product advertisements, or CEO interviews, these companies are always in the spotlight. It is definitely wise to keep an eye on what’s on the news, but don’t miss out on the real picture. Remember that you ultimately make a profit through price action.

- Keep track of the leading stocks and the rumblings of the market

Often, the high performing stocks can proceed much further and move much more rapidly than critics claim. This is the real story of today’s stock market. Hence, it is important for you to know which of the stocks are actually extensively crushing the current market. By doing this, you will also get a stable trading scope on both breakouts and pullbacks.

Some of the many pluses of using the swing trading method

Now that you are aware of what is swing trading and its technical and implementation details, summarised here are some of the general advantages of the method. Swing trading is a method that has been around for quite some time now in the business industry, and has benefited traders in different ways. Here are some general benefits of swing trading as per previous research:

- You can get hold of outcomes quickly

Swing trade is one of the best strategies for stock traders who do have the time and patience to wait for the results. Compared to other strategies, it will reveal the status of your strategy implementation in less than one week. This will give you the leverage to tweak and modify your swing strategy consistently until you reach your intended goal. It is an excellent opportunity to earn money consistently.

- Can generate monthly income

As you already know that swing trading is a short term strategy, there is no question of long-term investing and waiting. You will always be able to keep track of how much earnings have arrived your way and how much you take out of your account as an income. You will also have the option to extend the amount of your earnings by launching three to five trades a week in parts, which are usually realised and wrapped up in less than twelve days.

- It will save you time

Not only that, swing is a category of trading that does not require consistent monitoring. This is one of the main reasons why investors settle for this option, especially the ones who lack time. People who get involved in part-time businesses while working full time find this a really convenient strategy to boost their trade. As you become proficient with technical analysis, it will certainly not take much time to spot the primary trends and fine tune your venture.

As stated, swing trading is a robust and comparatively simple trading strategy, but it is only simple when you understand the underlying factors related to it, implementation tactics, technical aspects, and more. With a proper trading system comes sound financial management. You also open your doors to unimaginably high returns on your account with the help of the swing system. Demonstrated above in detail was what is swing trading and every related factor it entails that will serve you best in today’s saturated stock market scenario.

The swing trading plan is a great way of getting high returns today. It is highly strategic, as you are now aware of what it involves, and thus the chances of business turn-downs are much lower. In aiding your business to spot its target markets, easily develop a robust promotional strategy, set measurable objectives, and implement the best marketing plans, a swing trading strategy accelerates many things. In simple terms, it is a feasible and effective strategy that can be used to bring about productive outcomes.